Highwoods Properties Inc

Latest Highwoods Properties Inc News and Updates

A rebound in capacity utilization helps office REITs like SL Green

While most people don’t think of industrial data affecting office REITs, it does influence the top-line growth of commercial REITs like SL Green (SLG).

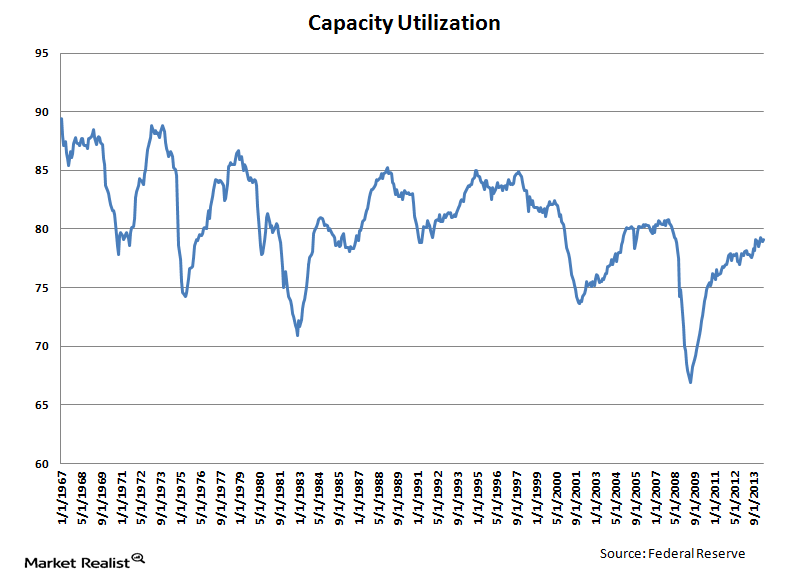

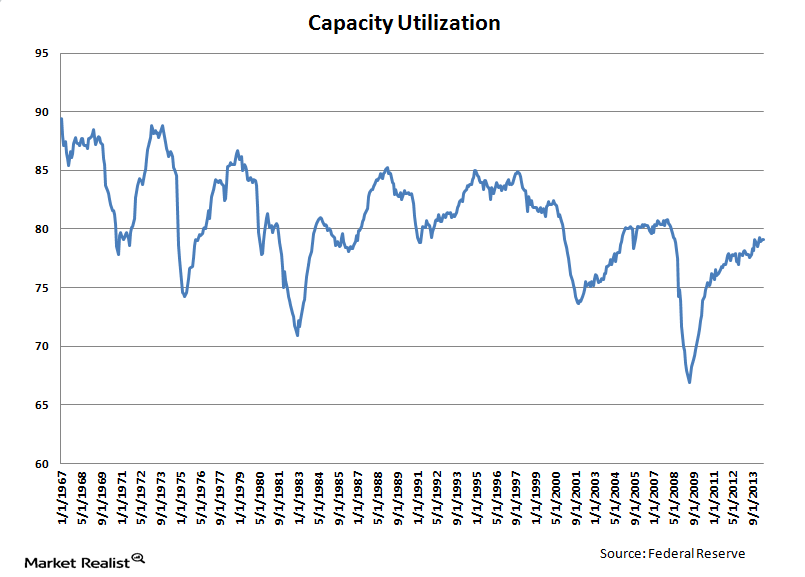

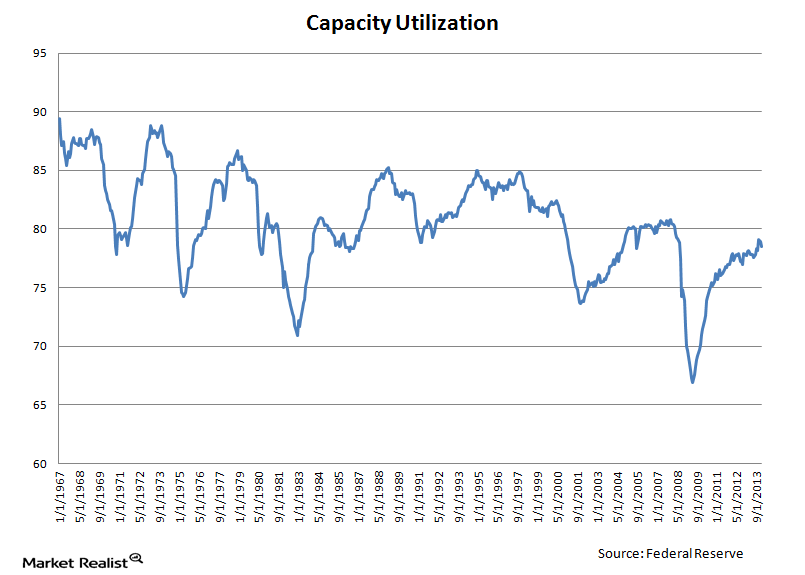

Why capacity utilization is an important economic indicator

Capacity utilization rates are approaching long-term historical averages.

The US witnesses an unexpected drop in capacity utilization

From 1972 to 2012, capacity utilization averaged 80.2% and bottomed at 66.9% in 2009 suggesting there’s a lot of room for production to expand before we start feeling inflationary pressures.