Huntington Bancshares Inc

Latest Huntington Bancshares Inc News and Updates

TCF and Huntington Merger Will Create a Midwest Banking Dynamo

Two banks walked into a bar. Here's what to know about the Huntington-TCF merger. How will the merger impact both banks?

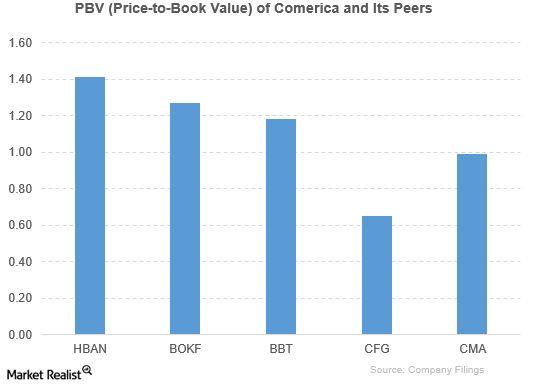

How Did Comerica Perform Compared to Its Peers?

The peers outperformed Comerica based on the PBV ratio. However, Comerica is way ahead of its peers based on the forward PE ratio.