Fifth Third Bancorp

Latest Fifth Third Bancorp News and Updates

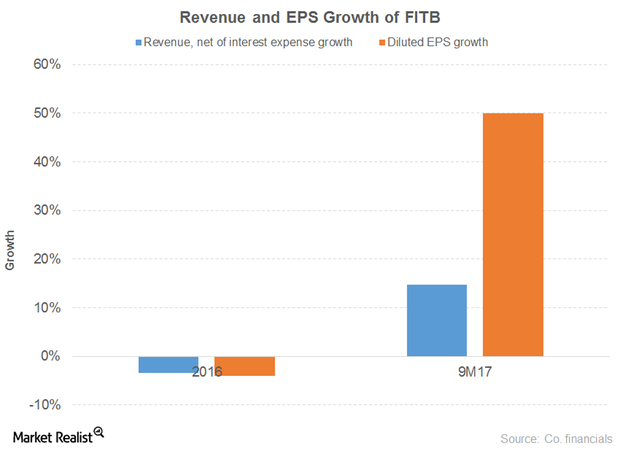

How Fifth Third Bancorp Has Performed Recently

Fifth Third Bancorp has an impressive free cash flow position.

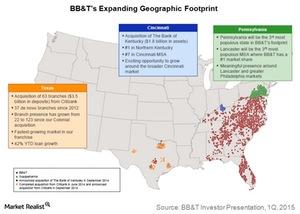

BB&T to Expand Its Footprint in Ohio and the Mid-Atlantic Region

BB&T’s Susquehanna acquisition will significantly expand BB&T’s Mid-Atlantic footprint. The deal is valued at ~$2.5 billion. It will close in the second half of 2015.