Evercore Inc

Latest Evercore Inc News and Updates

How Evercore Chairman Roger Altman Made His Millions

With Evercore’s first-quarter earnings report, it’s worth learning about its founder and chairman Roger Altman and his net worth.

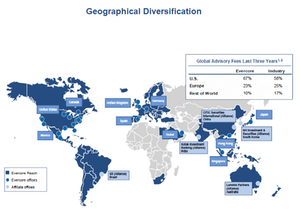

A Look at Evercore’s Business Model

Evercore generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17.

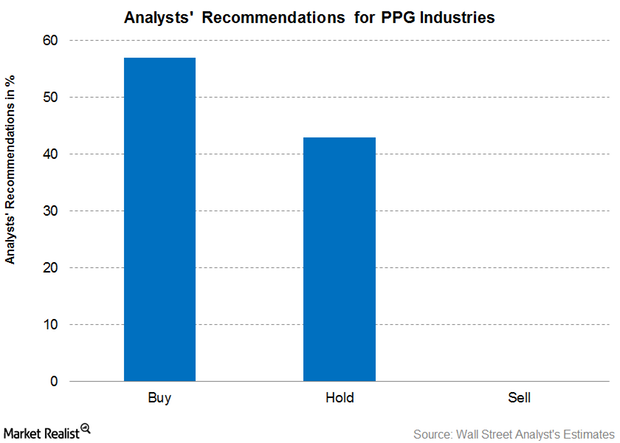

What Analysts Recommend for PPG Industries

As of March 23, 2017, 21 brokerage firms were actively tracking PPG Industries (PPG) stock.