EMCOR Group, Inc.

Latest EMCOR Group, Inc. News and Updates

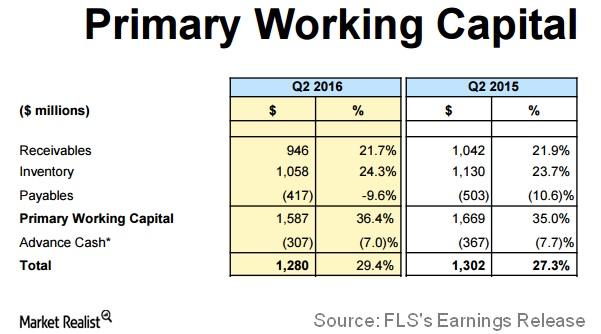

A Glance at Flowserve’s Primary Working Capital after 2Q16

In the current volatile global scenario, Flowserve’s (FLS) 2Q16 revenue and net profit have risen by 11% and 28%, respectively, year-over-year.

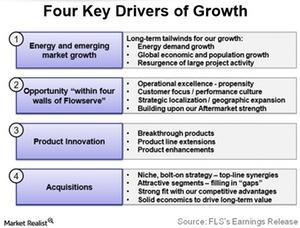

Why Do Customers Buy Flowserve’s Products?

After 4Q15, FLS reported that it controlled a market share of 4% of the $130-billion pump, valve, and seal market in 2015.