New Oriental Education & Technology

Latest New Oriental Education & Technology News and Updates

New Oriental Shareholders Flee, China Restricts Tutoring Companies

New Oriental Education (NYSE:EDU) stock has suffered serious damage. What happened, and is a rebound surmountable?

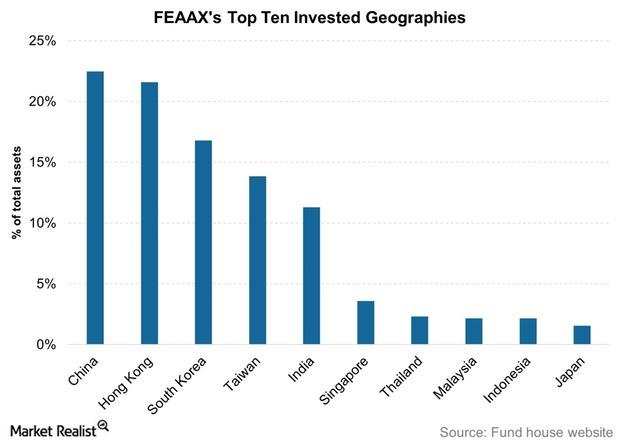

What You Should Know about FEAAX

FEAAX has existed since March 1994 and has an expense ratio of 1.4%. You require a minimum of $2,500 to invest in this fund via Class A shares