Carter's Inc

Latest Carter's Inc News and Updates

Morgan Stanley Rated Carter’s as ‘Overweight’

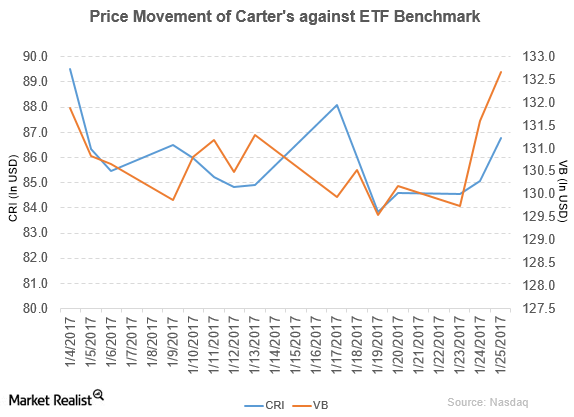

On January 25, 2017, Morgan Stanley initiated the coverage of Carter’s with “overweight” rating. It set the stock’s price target at $103.0 per share.

Citigroup Upgrades Carter’s to a ‘Buy’

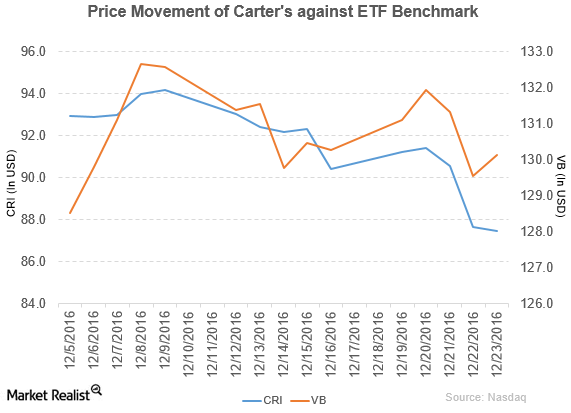

Carter’s (CRI) fell 3.3% to close at $87.48 per share during the third week of December 2016.

Citigroup Gives B&G Foods a ‘Neutral’ Rating

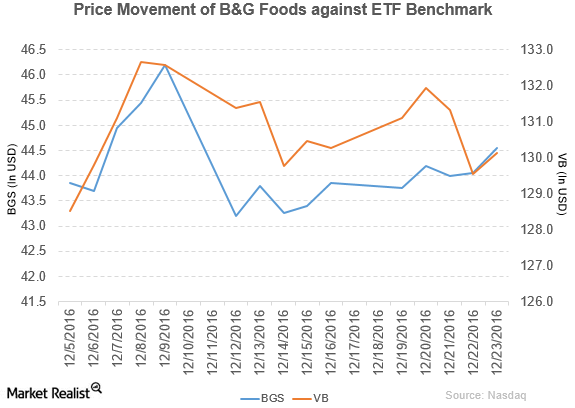

B&G Foods (BGS) rose 1.6% to close at $44.55 per share during the third week of December 2016.

Carter’s Declares Dividend of $0.33 Per Share

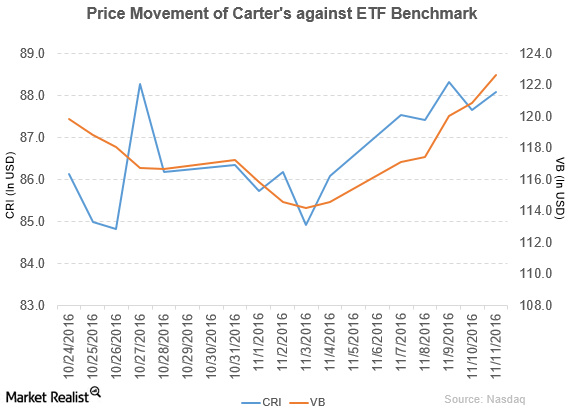

Price movement Carter’s (CRI) has a market cap of $4.4 billion. It rose 0.48% to close at $88.09 per share on November 11, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 2.3%, 0.92%, and -0.06%, respectively, on the same day. CRI is trading 2.0% above its 20-day moving average, 2.1% below […]

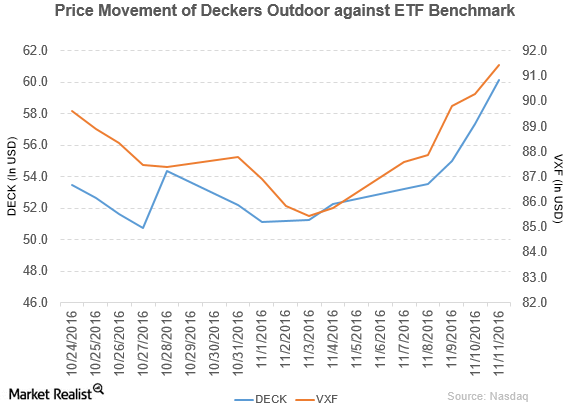

Stifel Upgrades Deckers Outdoor to a ‘Buy’

Price movement Deckers Outdoor (DECK) has a market cap of $1.9 billion. It rose 4.9% to close at $60.17 per share on November 11, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 15.2%, 5.7%, and 27.5%, respectively, on the same day. DECK is trading 11.7% above its 20-day moving average, 3.8% […]