CNH Industrial NV

Latest CNH Industrial NV News and Updates

How Did PACCAR Perform in 1Q16?

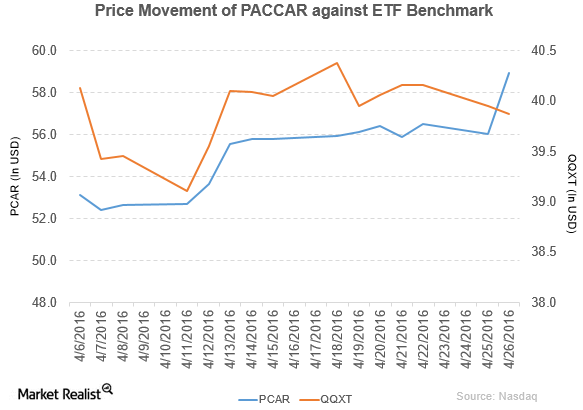

PACCAR (PCAR) has a market cap of $20.5 billion. PCAR rose by 5.1% to close at $58.93 per share on April 26, 2016.

PACCAR’s Revenue and Income Rose in 2015

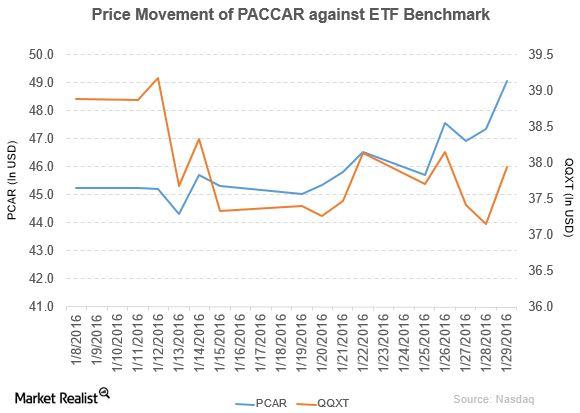

PACCAR (PCAR) rose by 5.5% to close at $49.07 per share at the end of the last week of January 2016.