Aviva PLC

Latest Aviva PLC News and Updates

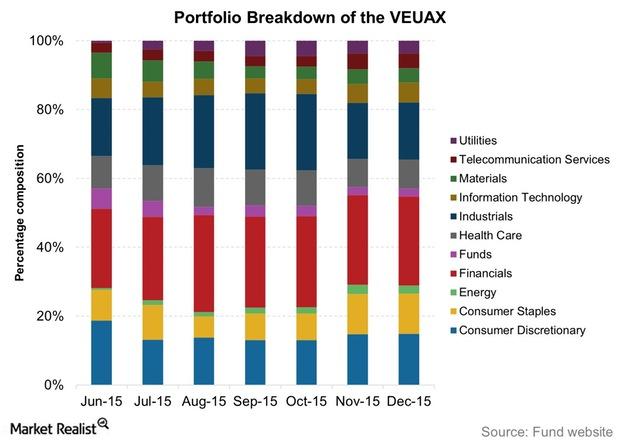

Analyzing JPMorgan Intrepid European Fund’s Allocation in 2015

The JPMorgan Intrepid European Fund’s assets were spread across 79 holdings as of December 2015.

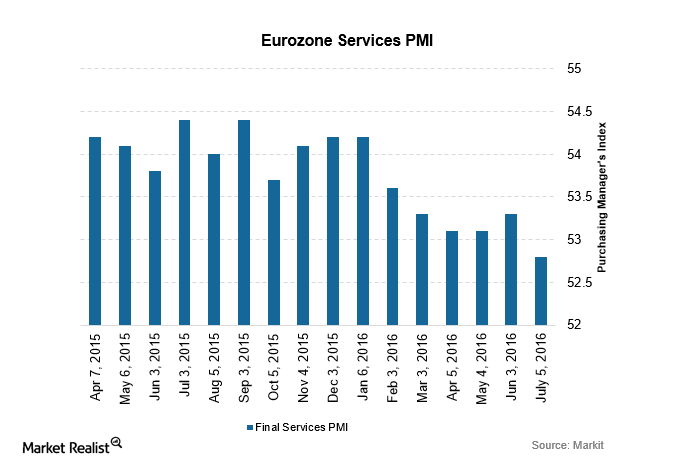

Contrasting Services PMI from the Eurozone and the UK

The composite PMI came out at 53.1—above the flash estimates of 52.8. The rise was primarily due to the rise in manufacturing production.