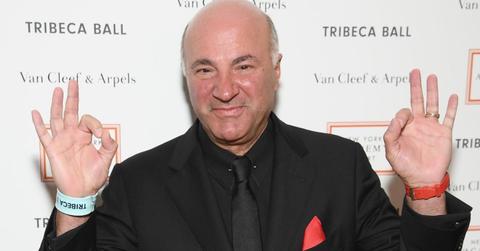

Want to Survive This Recession? Kevin O’Leary, aka Mr. Wonderful, Offers His Financial Advice

Before you consider taking your money out of the market, take Kevin O'Leary's financial advice. He believes you are better off keeping your money in index funds.

Oct. 11 2022, Published 2:17 p.m. ET

The U.S. economy is pretty scary right now. Rents are increasing, gas prices are rising again, and it’s hard to leave the grocery store without spending at least $100 on just a few essentials.

You may also be agonizing over your investments in the stock market. In September, the average U.S. stock mutual fund or ETF was down over 17 percent YTD, The Wall Street Journal reports. The S&P 500 dropped to its lowest level in 2022, according to CNBC.

Kevin O'Leary’s financial advice is to keep money in index funds.

But before you consider taking your money out of the market, take some financial advice from Shark Tank’s “Mr. Wonderful,” Kevin O’Leary. O’Leary believes you are better off keeping your money in index funds even in a volatile market than in a low-interest savings account.

“Right now, in a bank account, you’re getting [very little] interest,” O’Leary told CNBC. “And inflation is over 6 percent. So you’re actually losing money every 12 months.”

The interest rates offered on high-yield savings accounts have risen since CNBC talked to O’Leary in April, but so has the rate of inflation. According to U.S. Inflation Calculator, the inflation rate is now at 8.3 percent.

While the average interest rate for savings accounts is 0.16 percent, some high-yield accounts offer interest rates over 2.0 percent, Bankrate reports.

Kevin O’Leary’s recommends saving one-third of your income.

O’Leary still believes everyone should have some savings to fall back on in an emergency. While financial guru Suze Orman recommends having a year's worth of expenses in your savings account, O’Leary’s suggested savings goal is more modest. He says you should have three months' worth of salary in the bank in case of emergencies, MarketWatch reports.

Ideally, people should put 33 percent of their income into savings, O’Leary said in a CNBC “Make It” video.

“You’ve got to put something aside. Not everyone can put 33 percent aside in savings, but you’ve got to put at least 10 percent,” O’Leary says.

When it comes to personal finance, O'Leary says people should spend one-third of their income on housing, one-third on living expenses, and one-third on saving.

“If you let your house that you are buying or the place that you’re renting be more than a one-third of your after-tax cash flow, you’re going to put tremendous stress on yourself,” O’Leary said in the CNBC video.

O’Leary says don’t buy a house that costs more than one-third of your income.

You shouldn’t buy a house that’s going to cost you more than one-third of your income after taxes, O’Leary says. To stay within that financial target, you may have to look at buying a smaller house or moving outside the city to the suburbs where you can get “more bang for your buck,” according to O’Leary.

“There’s nothing wrong with buying a smaller home, living there for five years, selling it, buying a bigger home as your income goes up,” O’Leary said.

“Live within the means of one-third, one-third, one-third and at minimum to invest off your paycheck is 10 percent,” O’Leary said.