Value of the Indian Rupee Plummets Amid a Surge of COVID-19 Cases

With the dive in value, the Indian rupee is now seen as Asia’s worst-performing currency. Here's why the rupee is falling.

April 9 2021, Published 7:43 a.m. ET

In the biggest plunge in two years, the Indian rupee lost 1.6 percent on Wednesday to close at 74.5650 per dollar. That makes this the lowest level the currency has been since November of last year.

With the dive in value against the U.S. dollar, the Indian rupee is now seen as Asia’s worst-performing currency.

Why is the Indian rupee falling against the dollar?

The plunge came on the heels of the Reserve Bank of India's (RBI) announcement of its plans for a massive government bond-buying program. The central bank said it would buy one trillion rupees ($14 billion) of bonds in the secondary market this quarter, in addition to its existing liquidity operations.

Even though the central bank kept interest rates at record lows, its commitment to the bond-buying program raised prospects of rupee liquidity and potential inflation, both of which undermine feelings toward the currency, Reuters reported.

The head of currency research at Emkay Global Financial Services told Reuters, “The forex market wasn’t expecting such a dovish stance and rupee got set on fire.”

A surge in coronavirus cases could have impacted the devaluation

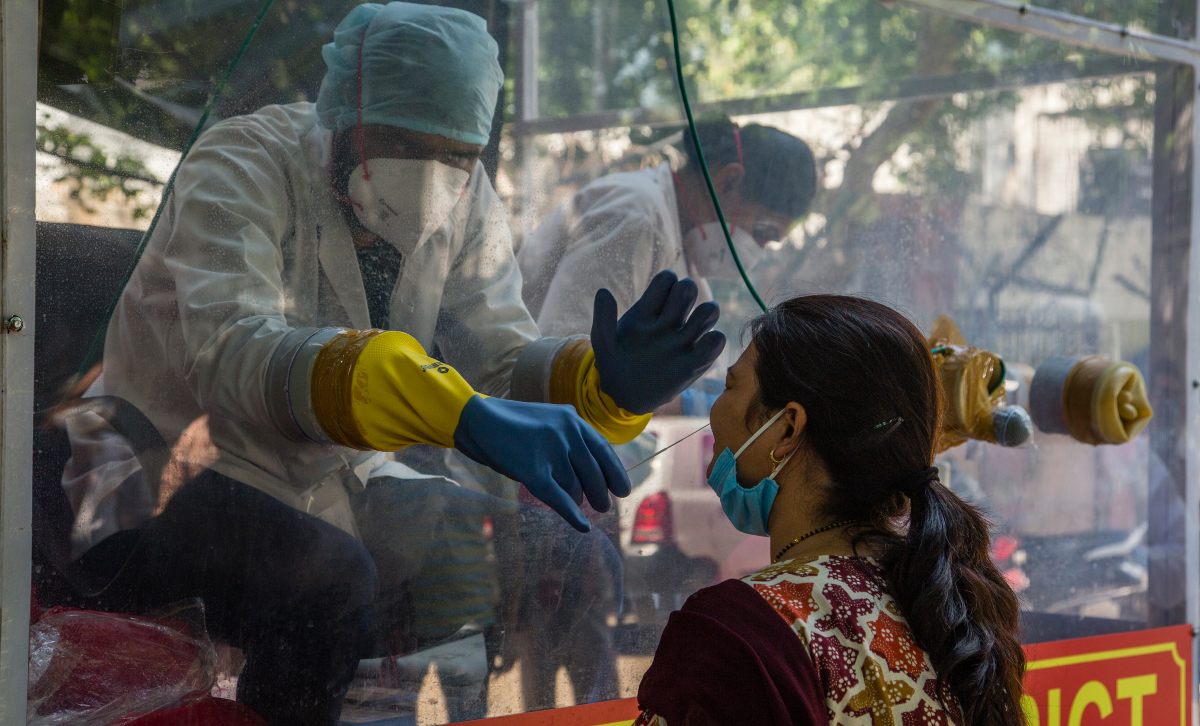

The central bank’s decision to keep interest rates at the same level comes at a time when India is looking at another shutdown due to a surge in COVID-19 cases. On April 7, the country reported 126,789 new cases, up from 11,831 just two months ago.

India has the third-highest number of deaths from COVID-19, behind Brazil and the U.S. The country’s pandemic curve had been flattening at the start of this year but took an upturn in March. As of March 29, the country had 12 million cases and 162,000 deaths from the virus.

The history of the rupee value

The value of the rupee was the same as the dollar back in 1947 when India gained its independence from British rule. Devaluation of the currency has happened at least three times since then.

Between the 1950s and 1960s, the rupee dropped to 4.75 per dollar due to the continuous borrowing of foreign money by the Indian government.

Then, with an increase in inflation due to wars with China and Pakistan and a crippling drought in 1966, the Indian government devalued the rupee to 7 per dollar in hopes that would spur foreign trade.

The country needed to borrow foreign money again in 1973 to pay a bill for imported oil, so the rupee’s value was reduced again.

The value of the rupee has steadily declined year over year. In 2015, it was valued at 63.76 per dollar.

The Indian rupee is different than the Pakistani rupee.

India’s neighbor to the west, Pakistan, also uses a rupee for currency, but the two currencies are not valued the same. The Pakistani rupee is currently valued at about 153 per dollar as opposed to the Indian rupee, which sits at 74.54 per dollar.