Did You Receive Notice CP80 From The IRS? — Here's What It Means

People are becoming alarmed after receiving notice CP80 from the IRS. It requests filers resubmit, but there are exceptions. Here is what you need to know and what it means for your taxes.

Feb. 11 2022, Published 3:39 p.m. ET

Woman looks through her mail

The Internal Revenue Service (IRS) backlog of unprocessed tax returns may have resulted in people getting CP80 notices even if they submitted their return for 2020. Causing alarm and panic in taxpayers people are now wondering what the CP80 letter means and if they need to refile. Here’s what the notice may mean, and what filers should do if they received one.

The IRS backlog is creating confusion amongst filers. People who have filed on time for previous years are now receiving a form from the IRS asking that they refile. However, there are some exceptions to the request.

Tax papers next to hourglass

The IRS backlog is affecting 2020 and 2021 returns.

According to the IRS by late December it had a backlog of "6 million unprocessed original individual returns (Forms 1040), 2.3 million unprocessed amended individual returns (Forms 1040-X), more than 2 million unprocessed employer's quarterly tax returns (Forms 941 and 941-X), and about 5 million pieces of taxpayer correspondence"

National Taxpayer Advocate Erin Collins reported in January of 2022 that this year represents the most difficult year for taxpayers and professionals.

In her annual report to Congress, she revealed that 77 percent of people that filed their returns are expecting a refund and “processing delays translated directly into refund delays.” Additionally, from 2010 to the present, the IRS workforce has decreased by 17 percent while the workload increases by 19 percent.

Needless to say, this tax season appears to foreshadow higher levels of frustration for both the IRS and taxpayers.

Array of tax forms needing to be filled out

What does the CP80 notice mean and should you refile?

The backlog has resulted in people getting CP80 notices in the mail. According to the IRS, a CP80 notice refers to the following situation, “We credited payments and/or credits to your tax account for the tax period shown on your notice. However, we haven’t received your tax return.” The notice then goes on to ask the recipient to file a new tax return for the requested year.

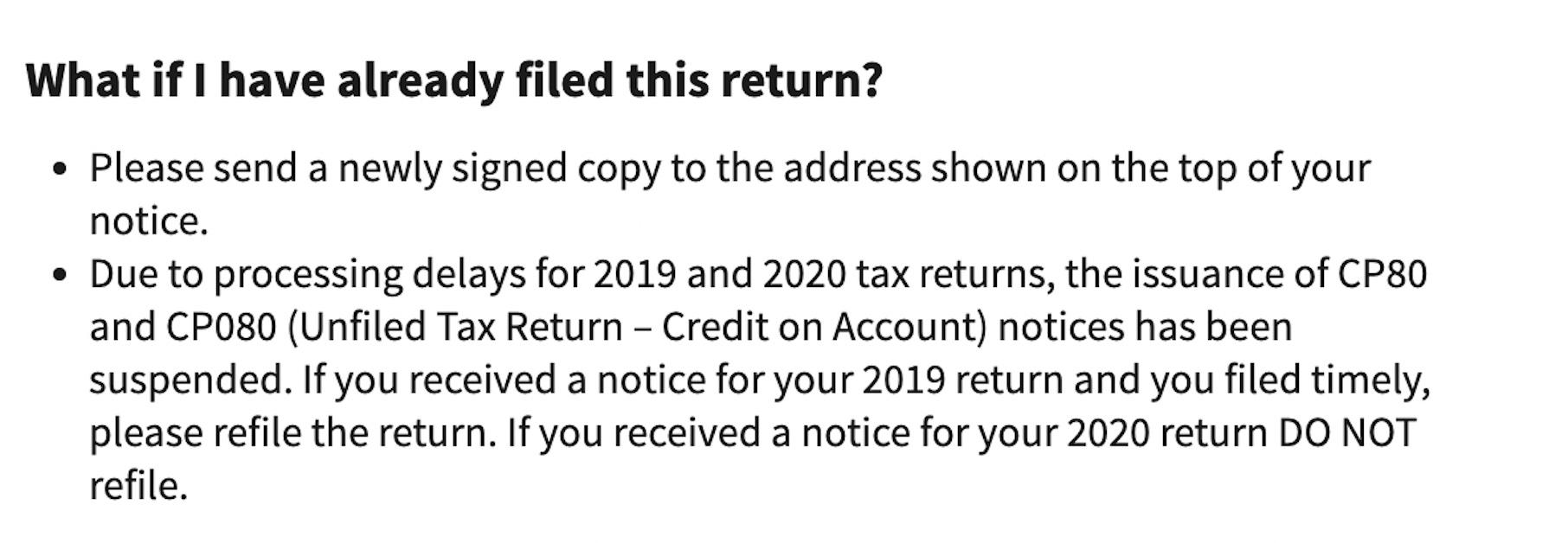

If the taxpayer did in fact file they are still asked to send a new copy with their signature on it. But, due to the backlog, the IRS stated that they have suspended sending CP80 notices.

However, people who have already received CP80 notices before their suspension of them are trying to figure out what they should do in response.

New Jersey CPA John Sessa told CNBC that a few of his clients have already received the notices however he recommended that they do not refile, “that’s just going to cause more of a delay.”

The IRS website has updated its page on CP80 notices in which they say that if a person receives a notice for a 2019 return that was submitted on time, they should refile their return.

But, if they received a notice for their 2020 return, they should NOT refile.

Filers should contact the IRS just in case.

To mitigate work and stress, filers are encouraged to access a free IRS transcript. The transcript will show when it was filed, any payments (if necessary), and a confirmation that the IRS received the return. All of this information is available even if the IRS has not yet processed the return. Sharif Muhammad, CEO of Unlimited Financial Services, commented that not only is there a backlog of returns, there is also a backlog of paper.

Muhammad also encourages people who received a CP80 to contact the IRS, saying, "it is imperative to get on the phone with the IRS.” Once the person can speak with an agent, he suggests that they explain whether or not they filed and then fax over any necessary confirmations.

If they cannot speak to an agent, they should pursue making an appointment with their local IRS office.