Is Being a Doordash Driver Worth It?

DoorDash is one of the biggest food delivery platforms in the U.S. But how profitable can a DoorDash driver be?

Aug. 26 2021, Published 5:40 a.m. ET

Online food delivery has changed the way we order food. All from the palm of our hand, we can easily order meals from local restaurants. The COVID-19 shutdown has boosted demand for online food delivery services even more.

Since it was founded in 2013, DoorDash has become the leading company in online food ordering and delivery across the U.S. The company has surpassed peers Grubhub, Uber Eats, and Postmates, despite being the second-youngest in the group.

In 2020, Business of Apps ranked DoorDash first in the U.S. food delivery app market, with a 45 percent share, And in Jul. 2021, Bloomberg Second Measure reported that DoorDash had the largest share of sales among meal delivery platforms, with 57%. So, we can see that DoorDash is the top option for consumers across the country. But how does it fare for its delivery drivers?

The breakdown of how DoorDash drivers are paid

Delivery drivers, or “Dashers,” have their total earnings broken down into base pay, promotions, and tips. DoorDash states that the base pay ranges from $2–$10+ per delivery, depending on the “estimated duration, distance, and desirability of the order.” Deliveries that are more time-consuming, cover longer distances, and are less popular will have a higher base pay. DoorDash drivers can also keep 100 percent of the tips they receive.

To help its drivers earn extra money, DoorDash offers some promotions. One is the completion of "challenges"—if drivers complete a certain number of deliveries within a certain time, they can earn more. Drivers are automatically enrolled in the challenges if they’re eligible and have the option to complete them or not. The challenge program is currently in beta phase, so it's not available to all drivers, but DoorDash says it will expand the program in the near future.

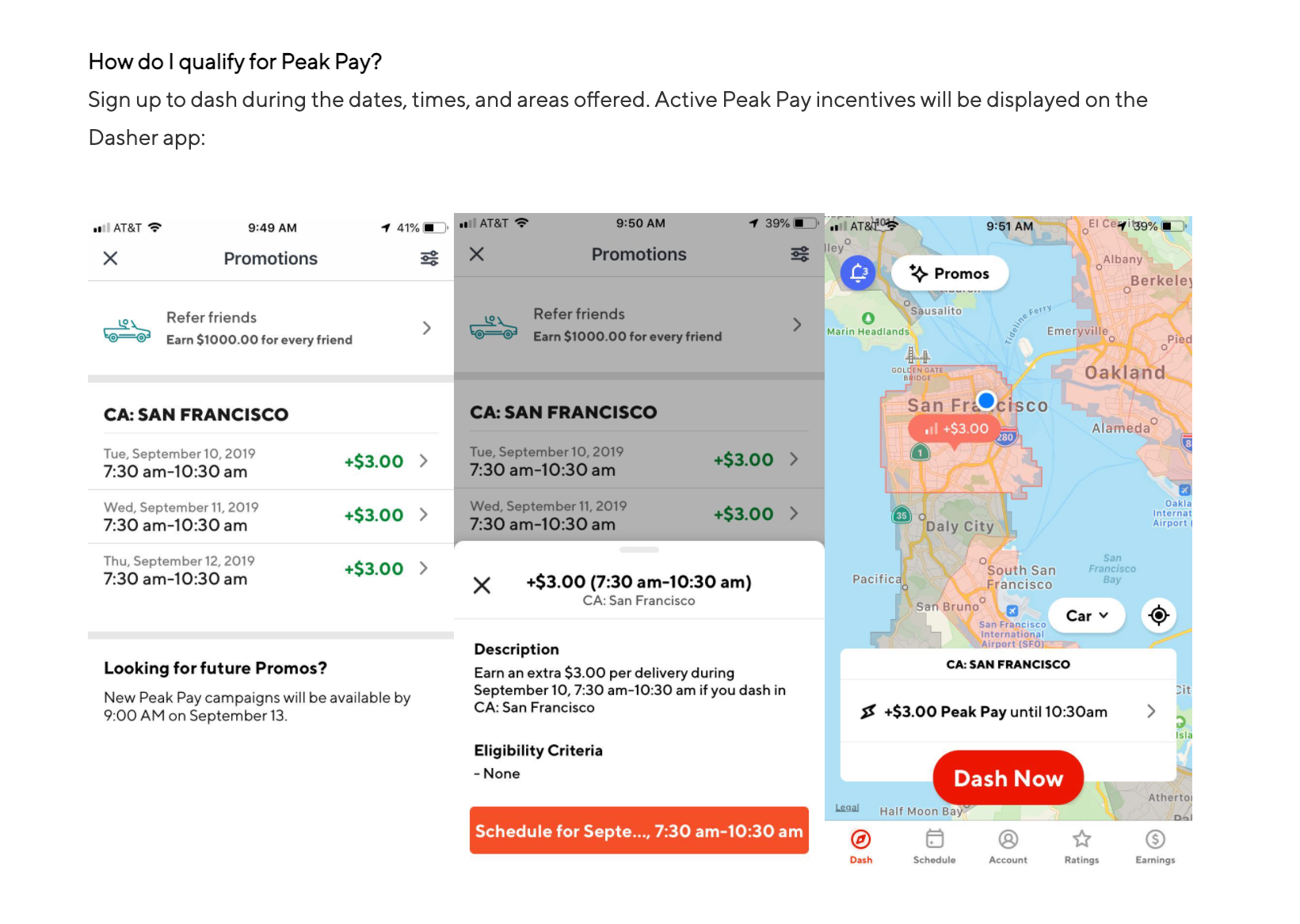

There's also DoorDash's Peak Pay program, which allows drivers to earn extra money per delivery, depending on the time and area. It’s similar to charging a higher fee for using a ride-sharing service during peak times in a metro area. Finally, through DoorDash's Guaranteed Earnings program, select drivers can earn a guaranteed amount if they complete certain tasks.

How does DoorDash's pay compare with other food delivery companies'?

DoorDash, GrubHub, Uber Eats, and Postmates calculate their earnings very similarly. The state the driver is in also determines their total earnings. DoorDash's three competitors do not publicly list their minimum or estimates of base pay, but they do list their formulas:

- GrubHub totals mileage per order, time spent on the road, tips, and special offers to calculate total pay.

- Uber Eats sums up base fare, trip supplements, promotions, and tips. The base fare is the pickup, drop-off, time, and distance. The trip supplement is based on factors such as the total time and distance traveled.

- Postmates uses the amount of each completed pickup, the amount of each completed drop-off, a per-minute rate for the time spent at the pickup location, a per-mile rate for the distance traveled between the pickup and drop-off locations, and tips.

With the total earning calculations of each company being so similar, it’s unclear to say which pays better. However, it’s plausible to assume that DoorDash offer its drivers more delivery opportunities, as it's the top platform for consumers.

What can DoorDash drivers claim as expenses?

In 2020, Dashers earned an average of $22 per hour before taxes, DoorDash told CBS. That hourly salary may be sufficient income, depending on the person. Fortunately, drivers can deduct expenses (vehicle mileage, car insurance, tolls, parking, and phone costs) when reporting their income to the IRS.