How to Avoid or Reduce Capital Gains Taxes on Stocks

How can you avoid paying capital gains taxes on stock investments? Here are some legal ways to lower your tax burden on stock earnings.

April 23 2021, Published 3:28 p.m. ET

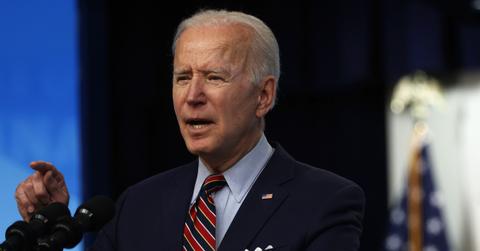

President Biden’s tax proposal to help fund the American Families Act includes a much-higher capital gains tax. The hike has quite a few wealthy Americans on edge. Though he hasn’t officially unveiled the plan yet, sources say he intends to raise the capital gains for income amounts exceeding $1,000.000 a year to 39.6 percent.

The income tax rate would also rise by 2.6 percent under this plan (from 37 percent to 39.6 percent), while the impact on capital gains would be much more dramatic. 39.6 is nearly double the rate it is now (20 percent).

Capital gains happen when an investor sells an asset for more than they paid to acquire it. For example, if you purchase shares of a stock and later on sell it when the price is much higher, the difference between the purchase price and the selling price is your capital gain. These are taxed differently from regular income if you hold them for longer than one year.

Capital gains tax under Biden’s proposal

President Biden’s proposed “American Families Plan” would only raise capital gains taxes to 39.6 percent for Americans who earn above $1 million per year. This increase in the federal capital gains tax rate is intended to help fund new programs for childcare and education.

White House press secretary Jen Psaki said that Biden believes the wealthiest Americans, corporations, and businesses can afford the higher taxes needed to pay for programs.

What was the capital gains tax rate before Trump?

Capital gains tax rates have ranged over the past decades. From 1970 to 1979, the maximum rate was between 30.2 and 35 percent. Rates have regularly been above 20 percent, except for the years before 1941 and from 2004-2012. From 2004-2012, the maximum rate was just 15 percent.

The American Taxpayer Relief Act of 2012 raised the highest bracket of capital gains tax rates to 20 percent, and that rate remained throughout Trump’s presidency. If Biden’s proposal makes it through Congress, it would nearly double the maximum capital gains tax rate for the wealthiest Americans.

How to minimize capital gains taxes on investments

There are ways to minimize the capital gains you owe on your investments.

Tax-loss harvesting enables you to deduct losses on investments up to $3,000 on a joint tax return in one year, and additional losses can roll over to future tax years. The deducted losses can offset your capital gains on other investments.

In the 10 or 12 percent income tax bracket, you’ll have a zero capital gains tax rate. That’s with income limits of $40,000 for individuals and $80,000 for married filing jointly.

Make a direct donation of stock to charity rather than selling the stock first to donate the proceeds. You’ll sidestep capital gains tax completely, plus end up with a larger tax deduction for you and a larger donation for the organization.

If you bequeath stock to a beneficiary after your death, the beneficiary won’t pay capital gains taxes on investments that rose in value during your lifetime. (If you give them stock while you’re alive, the cost basis is passed on to them.)

Can I avoid capital gains by reinvesting?

One way to avoid capital gains taxes is by reinvesting capital gains from real estate into a similar investment. IRS Code Section 1031 enables you to pay no taxes on the gains from a property sale in certain circumstances.

Investopedia explains: “Under Section 1031, if you exchange business or investment property solely for a business or investment property of a like-kind, no gain or loss is recognized until the newly acquired property is sold.”