States Raise Hundreds of Billions From Sales and Excise Taxes, but What’s the Difference?

How is excise tax different from sales tax? Learn about the difference now that U.S. senators are talking about a federal cannabis excise tax.

Feb. 28 2022, Published 6:04 a.m. ET

How is excise tax different from sales tax? You might be curious about the differences between the two now that excise tax is a talking point in the push for the nationwide legalization of marijuana. As Roll Call reports, Senators Chuck Schumer (D–N.Y.), Ron Wyden (D–Ore.), and Cory Booker (D.–N.J.) are planning to unveil a marijuana-legalization bill in April, and a discussion draft of the bill included a federal cannabis excise tax, partly as a disincentive for use by minors.

As it turns out, sales tax and excise tax are big moneymakers for state governments. According to the Tax Policy Center, states reaped $300 billion in general sales taxes in 2017 and $157 billion in excise taxes. A 2011 policy brief from the Institute on Taxation and Economic Policy (ITEP) noted that sales taxes and excise taxes comprised nearly half of state tax revenue. So, what's the difference between the taxes?

Excise taxes apply to specific goods and services, and can be charged to retailers and manufacturers

As Bankrate explains, excise taxes are taxes on the purchase of specific goods or services, such as sales taxes. Unlike sales taxes, however, excise taxes may be charged to the manufacturer or retailer instead of the consumer. (Don’t get too excited about that, though: the cost is likely to be passed down to the consumer anyway, by way of higher purchase prices.)

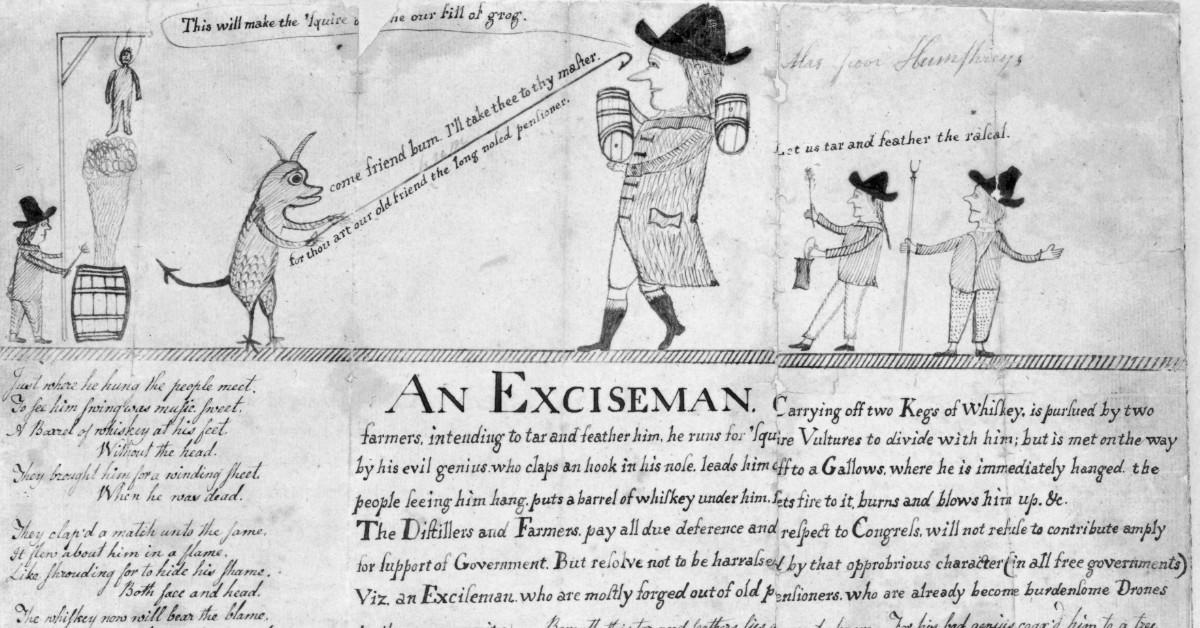

A political cartoon about the 1791 excise tax on whiskey in the U.S.

Some excise rates—those informally dubbed “sin taxes”—apply to tobacco products, alcohol, and gambling. (In fact, the first excise tax enforced in the U.S was a tax on whiskey that was passed in 1791 and lasted until 1802, according to the Tax Foundation.)

But gasoline, airplane fuel, air travel, telephone service, and even indoor tanning can also be subject to excise taxes, Bankrate reports. And ITEP notes another difference between excise tax and general sales tax: excise taxes are generally applied on a per-unit basis and not as a percentage of a sale price as with general sales tax.

Sales taxes and excise taxes are both unfair to lower-income consumers, ITEP argues

In its policy brief, ITEP argued that sales taxes are “inherently regressive,” since they disproportionately affect low-income families. As the institute pointed out, consumer expenditure survey data shows that low-income families typically spend three-quarters of their income on items subject to sales tax, while the richest families spend only about a sixth of their income on it. That’s the equivalent of a 4.5-percent income tax rate for the poor and a one-percent income tax rate for the rich.

Also, because excise taxes are based on units sold—meaning the excise tax on the purchase of low-cost alcohol or cigarettes is equal to that of premium alcohol and cigarettes—excises taxes are “even more regressive,” the institute said. “Sales and excise taxes are paid by virtually everyone nearly every day,” ITEP concluded. “They’re a vital component of state and local tax systems, but their regressivity raises important issues of tax fairness.”