How Does the U.S. Government Borrow Money?

With the national debt rising in light of the COVID-19 pandemic, here's how the U.S. government actually borrows money.

Nov. 17 2020, Published 1:33 p.m. ET

Compared to personal debt—which averages $90,460 per American—the U.S. federal deficit is a whole different beast.

In October 2020 alone, the U.S. piled on an additional $284.1 billion to its federal deficit, which is a new monthly record. The total annual debt for the most recent budget year (which runs from October to September each year) was $3.1 trillion. The amount is more than twice the rate of the previous annual deficit record of $1.4 trillion—a number that was set in 2009.

What is the federal deficit?

The budget deficit is the difference between government spending and government revenue. Taxes make up most of the revenue.

For October, the government revenue hit $237.7 billion, which is a 3.2 percent decline from the same time last year, due in large part to a reduction in personal income taxes (because of higher unemployment). The month's spending hit $521.8 billion, which is a 37.3 percent increase from October 2019. Issues related to the COVID-19 pandemic increased the government's spending.

How does the government borrow money?

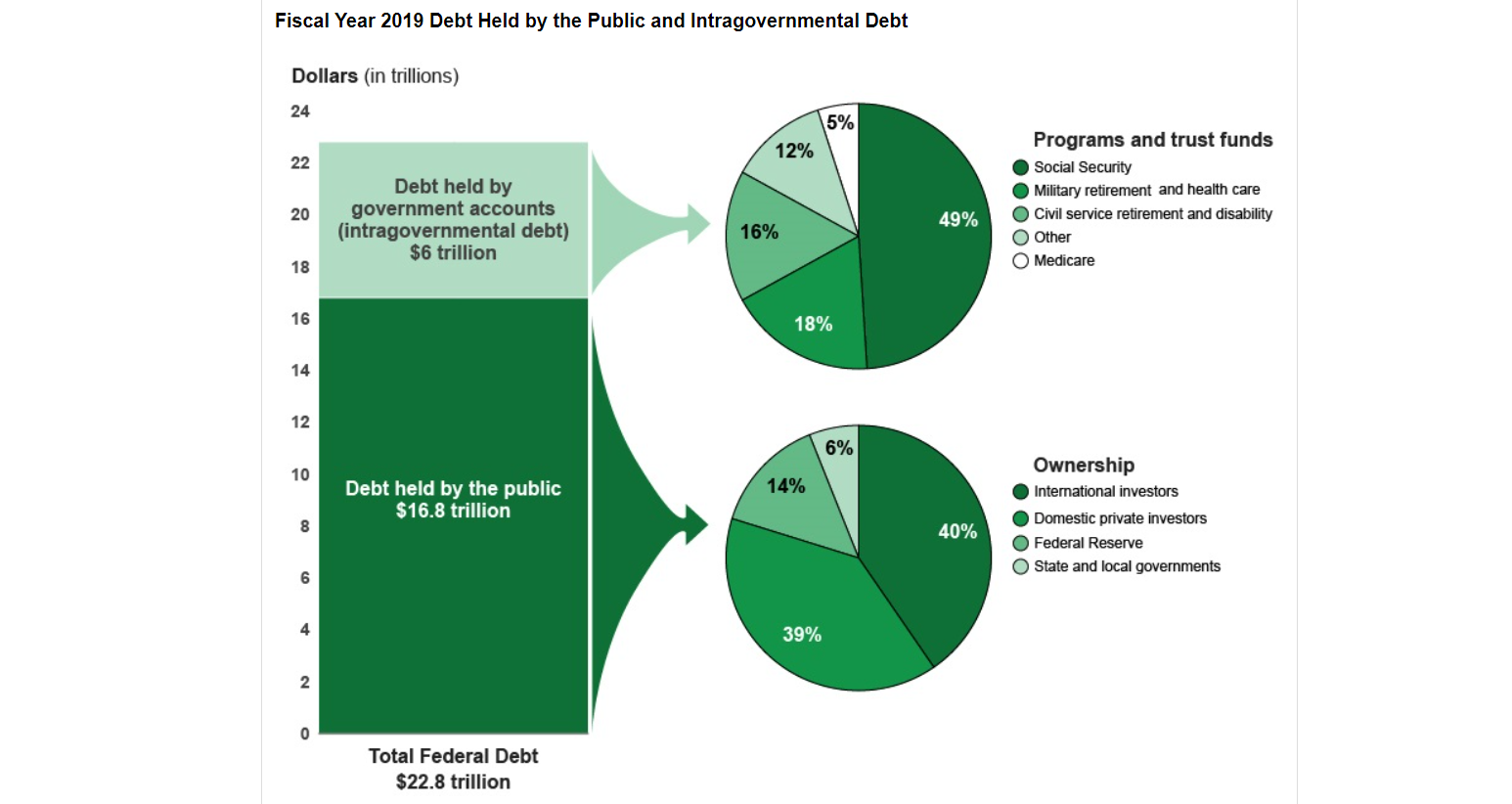

According to the U.S. Government Accountability Office, the federal government borrows money straight from the public. The government issues securities like bills, notes, and bonds through the U.S. Treasury.

Individual and institutional investors can back the government by investing in these types of securities and many choose to do so. These investments can reach maturity, are backed by the U.S. government, and are exempt from taxes at the state and local levels. Also, most securities (besides savings bonds) can be resold in the market.

Another way that the U.S. government borrows money is through intragovernmental debt like social security, healthcare, military retirement, and more.

Why does the government borrow money?

The U.S. government borrows money for a few reasons. The government may want to stabilize the economy during a recession (as exemplified by the most recent budget year). Also, the government might view increased spending as a less politically damning tactic to increase available funds compared to raising taxes.

There are also factors at play that increase spending, like aging populations receiving their social security payout at a higher rate than working-age people are paying it. Wars, natural disasters, and public sector investments may also play a role.

How can we reduce the national debt?

The U.S. government can work to reduce the national debt by cutting spending, manipulating interest rates, and raising taxes. The government can institute a national debt bailout (like it did with government-backed mortgage lenders Fannie Mae and Freddie Mac in 2008). The government can also default on the debt.

Can national debt be refinanced?

Homeowners can refinance mortgages. Can the U.S. government refinance its debt? Refinancing means getting a new loan from another institution with a lower interest rate or a longer plan that lowers the monthly payments. The government does this all the time.

The U.S. government rolls over the national debt on a regular basis in small bits. While the total public debt is somewhere along the lines of $20.3 trillion, it isn't one single bond worth all that money. It's a ton of individual securities, each with unique terms and interest rates. As debt securities continuously mature, the government refinances.

What does high national debt mean for U.S. citizens?

The higher the national debt, the more the government owes its investors. Potential downfalls of rising debt mean decreased economic stability, decreased currency value, stalled economic growth, and higher unemployment.

However, the debate about the national debt is ongoing. Some people say that national debt isn't anything to worry about and that it's manageable. As we head into 2021, the Congressional Budget Office projects the current budget year deficit to hit $1.8 trillion. Although, as we know from 2020, anything can happen.