Biden Said He’d Eliminate the Stepped-Up Basis Tax Loophole—What Does That Mean?

Biden may push for a bill for a new inheritance tax code: The U.S. president said during his campaign he’d close loopholes like the step-up in basis.

Feb. 14 2021, Updated 9:00 a.m. ET

President Joe Biden has more pressing concerns at the moment—the coronavirus vaccine rollout, for one—but once tax policy comes up on his agenda, Biden could push for a bill changing how inheritances are taxed.

In a “Wealth Matters” column for The New York Times, Paul Sullivan notes that “the biggest potential long-term change” to the tax code involves estate tax and, more specifically, the potential elimination of the step-up in basis.

A step-up in basis often reduces capital gains taxes, but it’s also a tax loophole for the wealthy.

A step-up in basis means that inherited assets are valued at the time of inheritance for capital gain tax purposes. For example, if you inherited stocks that were originally purchased at $2 a share and those shares are now worth $10 a share, then any capital gains tax you pay in the future will be calculated with $10 as the basis, not $2.

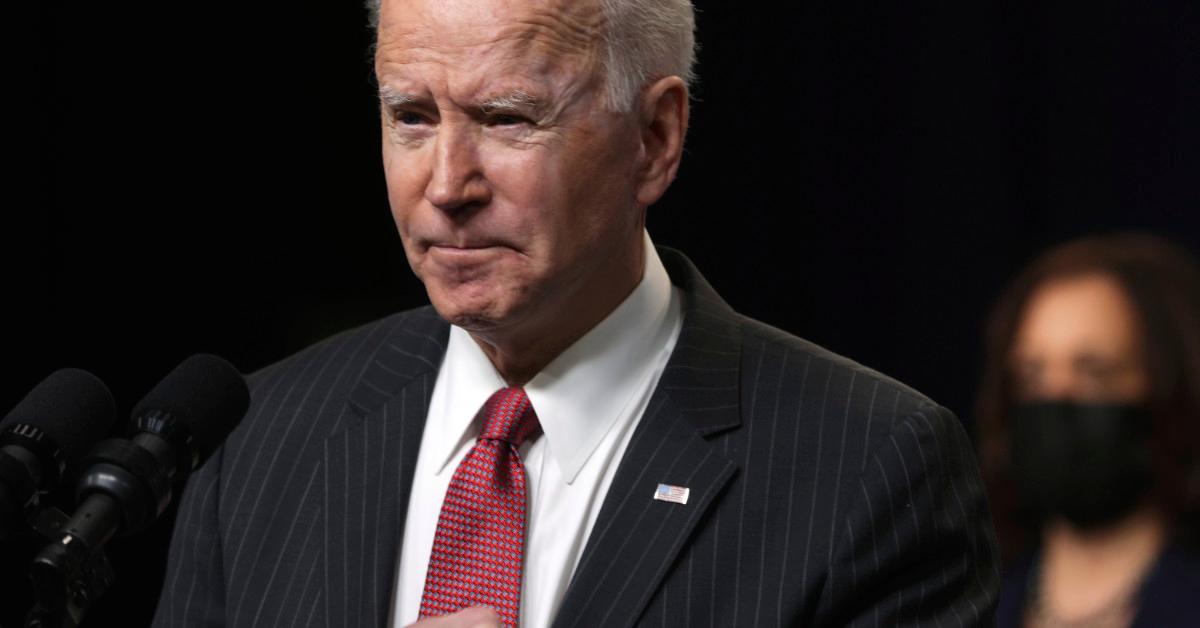

U.S. President Joe Biden makes a statement as Vice President Kamala Harris looks on at the South Court Auditorium at Eisenhower Executive Building in Washington D.C. on Feb. 10, 2021.

Similarly, if you inherited property originally purchased for $40,000 and now worth $100,000, then the basis for any capital gains tax would be $100,000, not $40,000. Later, if you sold the property for $120,000, you’d only have to pay tax on the capital gain of $20,000, the difference between your selling price and the property’s basis at the time of inheritance.

But critics of the step-up in basis say it’s a tax loophole the ultra-wealthy can use to avoid paying millions of dollars in taxes.

Social media users have sounded the alarm.

One popular Facebook post from October 2020 warned other users about Biden’s plans to eliminate the step-up in basis. “My educated guess would be that at least 95 percent of Americans don’t even know Biden has proposed this,” the post reads.

“We are talking tens of thousands of more tax dollars for the average [sic] sold after inheritance! Wow. Google ‘Biden stepped up basis’ and educate yourself because this is a biggie!”

Fact-checking articles at PolitiFact and KDSK rated this post as “true” and “mostly true,” respectively, though the latter website pointed out that the Facebook post “somewhat inflates the actual tax impact for most Americans.”

Biden proposed nixing the step-up in basis to fund free community college.

In October 2019, during his presidential campaign, Biden announced a higher education policy plan to offer two years of free community college to students, reduce student loan debt for students entering the public sector, allow students making less than $25,000 to defer their student debt interest-free, double the Pell grant maximum available to students, and invest $50 billion in high-quality job training programs.

And Biden’s campaign said at the time that the plan would be paid for by the elimination of the stepped-up basis and the capping of itemized deductions at 28 percent for wealthy Americans, according to ABC News.

Biden mentioned those plans again in June 2020 as he told potential donors how then-President Donald Trump had made it “much harder to foot the bill” of the current economic crisis.

“But even before the crisis, [Trump’s] irresponsible sugar-high tax cuts had already pushed us into a trillion-dollar deficit, and imagine what we could do now if we weren’t in that circumstance,” Biden added, per The Hill. “I’m going to get rid of the bulk of Trump’s $2 trillion tax cut, and a lot of you may not like that, but I’m going to close loopholes like capital gains and stepped-up basis.”