Steve Sage

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Steve Sage

Retail REITs Lead the Way with Top Performance in IYR

Retail REITs were the top performers of the iShares US Real Estate ETF (IYR) on January 5, 2016, with a return of 2.5%. The healthcare REIT subgroup ended the day with a positive return of 2.4%.

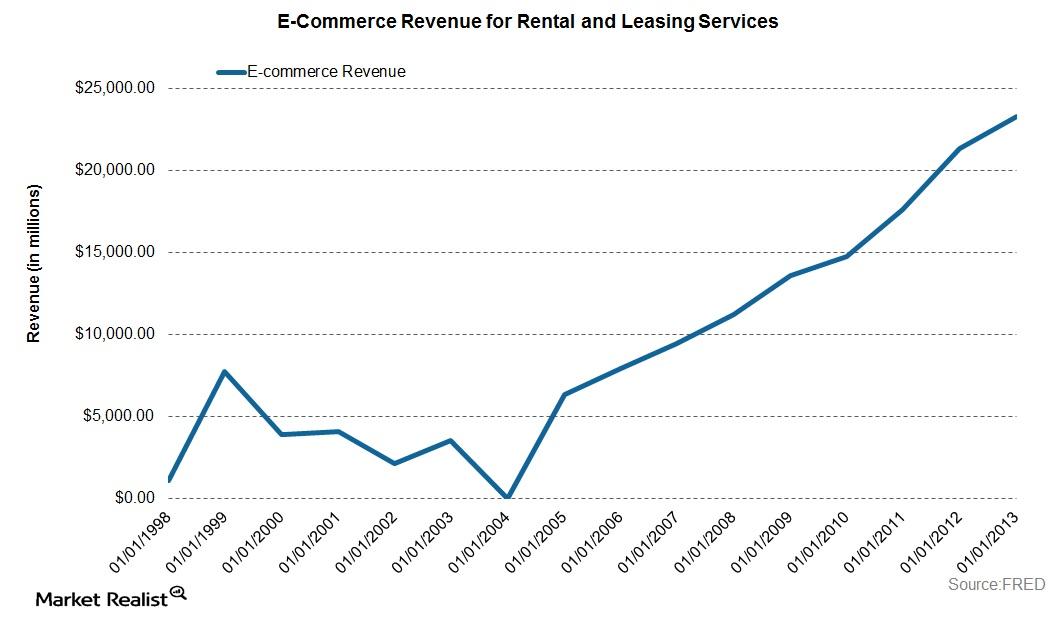

Specialized REITs: The Unsung Heroes

With the growing economy and global investment horizons, investments have shifted beyond the traditional options to specialized REITs.

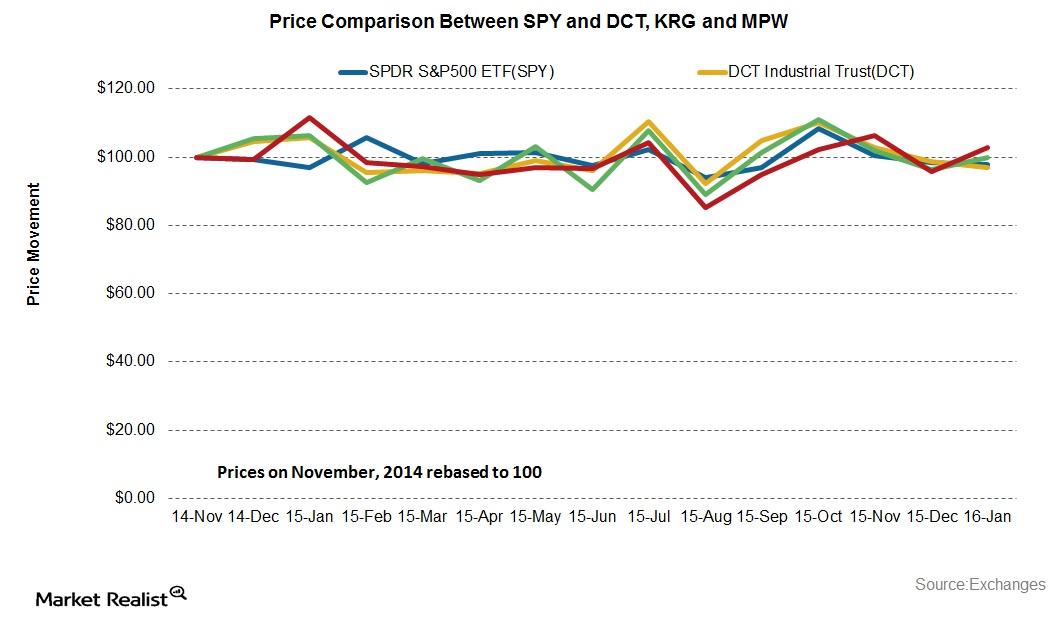

The Outlook for Industrial REITs

Industrial REITs are expected to pick up steam as the US economic outlook gradually improves—demand for industrial properties is tied to overall economic growth.