Dr. Brian Jacobsen, CFA, CFP®

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of Wells Fargo Funds Management.

More From Dr. Brian Jacobsen, CFA, CFP®

Fixed-Income Factors in Target Date Strategies

Fixed-income factors are not as widely discussed as equity factors, but they are equally important in designing a target date portfolio in an attempt to improve participant outcomes.

Putting the Factors Together

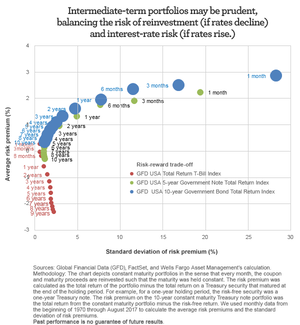

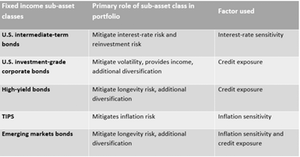

Each factor of a fixed-income portfolio—so interest-rate sensitivity, credit exposure, and inflation sensitivity—may play an important role in constructing a dynamic fixed-income portfolio for target date investing.

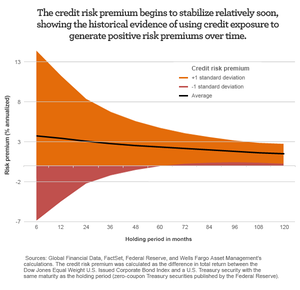

Factor: Credit Exposure

Another common factor in fixed-income investing is credit exposure because investing in securities with an element of credit risk has historically generated positive risk premiums over time.