Expedia Has an Attractive Valuation Multiple

Expedia stock is trading at a PE ratio of 22.07x. At the current multiple, the stock is trading at a discounted valuation compared to its peers.

Feb. 25 2019, Updated 7:30 a.m. ET

PE ratio

Currently, Expedia (EXPE) stock is trading at a PE ratio of 22.07x. At the current ratio, the stock is trading at a discounted valuation compared to its peers Booking Holdings (BKNG), Ctrip.com International (CTRP), and TripAdvisor (TRIP). Booking Holdings, Ctrip.com International, and TripAdvisor have PE ratios of 22.17x, 22.40x, and 33.19x, respectively.

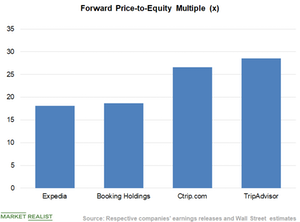

Based on analysts’ earnings forecast for the next 12 months, Expedia is trading at a discount compared to its peers. Expedia, Booking Holdings, Ctrip.com International, and TripAdvisor have forward PE ratios of 18.11x, 18.70x, 26.61x, and 28.55x, respectively.

EV-to-EBITDA multiple

The PE ratio is the most commonly used multiple due to its simplicity. However, the ratio has some flaws. A company’s earnings can be distorted due to the debt component in its balance sheet, which can make the multiple meaningless. So, investors can compare companies based on their EV-to-EBITDA multiples. The EV-to-EBITDA multiple neutralizes the impact of leverage in the company.

Currently, Expedia has an EV-to-EBITDA multiple of 12.16x, which is lower than its peers. Booking Holdings, Ctrip.com International, and TripAdvisor have EV-to-EBITDA multiples of 16.24x, 41.27x, and 23.32x, respectively.

Based on analysts’ EBITDA forecast for the next 12 months, Expedia is trading at a hefty discount compared to its peers. Expedia, Booking Holdings, Ctrip.com International, and TripAdvisor have forward EV-to-EBITDA multiples of 9.60x, 14.58x, 20.47x, and 14.83x, respectively.

Share performance

Expedia shares have made a remarkable run this year. The stock has gained 13.8% YTD (year-to-date) and has outperformed major US stock indexes’ returns. The Dow, the NASDAQ, and the S&P 500 have risen ~11%, 12.7%, and 10.8%, respectively, YTD.

Expedia shares have also outperformed other major online travel agencies’ (IYW) returns. Booking Holdings and TripAdvisor shares have risen 12.4% and 4.6%, respectively, YTD. Ctrip.com International is on top with a 23.2% YTD gain.