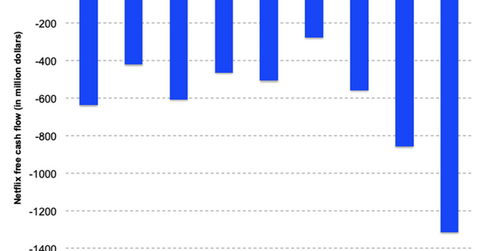

Should We Worry about Netflix’s Negative Free Cash Flow?

Netflix (NFLX) has been pouring money into creating original content or acquiring content, and this push may have intensified in light of media giants’ increasing competition.

Jan. 23 2019, Updated 9:00 a.m. ET

Netflix’s free cash flow in the fourth quarter

Netflix (NFLX) has been pouring money into creating original content or acquiring content, and this push may have intensified in light of media giants’ increasing competition. Its negative FCF (free cash flow) expanded YoY (year-over-year) in last year’s fourth quarter, to -$1.3 billion from -$510 million.

Netflix’s FCF for 2018 was -$3.01 billion, whereas it had forecast FCF of -$3 billion to -$4 billion. The company warned that although its FCF could be similar this year, it expects its FCF to start improving next year.

Should investors worry about Netflix’s growing debt?

Netflix has maintained its original programming at the standard expected by subscribers, which is why it has a loyal subscriber base and is attracting more subscribers.

The company’s long-term debt increased from $8.3 billion in the third quarter to $10.4 billion in the fourth, and it owes billions in off-balance-sheet debt. The debt has been worrying investors, especially as interest rates are rising, though its major content investments are easing some of those concers—they could yield long-term dividends as the company grows its user base.