AMC Entertainment: Analysts’ Recommendations

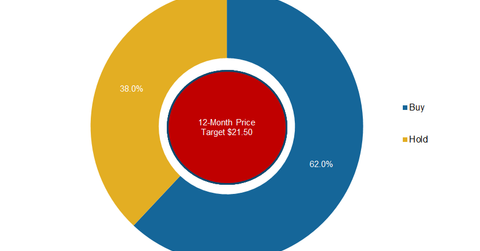

Among the 13 analysts covering AMC Entertainment (AMC) stock, 62.0% recommended a “buy,” while 38% recommend a “hold.”

Jan. 18 2019, Updated 2:15 p.m. ET

Why the “buy” rating

Among the 13 analysts covering AMC Entertainment (AMC) stock, 62.0% recommended a “buy,” while 38% recommend a “hold.” So far, there hasn’t been a target price revision in January. Analysts’ 12-month average target price of $21.50 for AMC indicates a 52.4% upside to its target price on January 17.

As of January 17, the stock has gained 14.9%. The stock closed trading at $14.11. In 2018, AMC Entertainment stock fell 18.7%.

AMC Entertainment has reported YoY (year-over-year) revenue growth in all three quarters in 2018. The company beat analysts’ estimate for all three quarters. The top-line growth was backed by strong movie releases, strategic measures, and acquisitions of Nordic Cinema Group, Odeon Cinemas, and Carmike Cinemas.

Adding recliners and large-format screens contributed to AMC’s top-line growth. Large-format screens require premium tickets. AMC added recliners to 288 US locations. By the end of 2018, the company aimed to have over 21 European theaters equipped with recliners.

AMC’s revamped food and beverage options should also add to its top-line growth. The Stubs A-list program is boosting AMC’s loyalty membership. AMC has collaborated with Groupon, Fandango, and Atom Tickets for distribution.

The competition is getting heated. Several theater chains are offering various subscription services. Although MoviePass was the original subscription service, it’s yielding massive losses due to the unsustainable nature of its business model. MoviePass has been trying to make changes to its subscription plans to increase its profits.

Cinemark’s ratings and stock movement

Among the 14 analysts covering Cinemark Holdings (CNK), 71.0% recommended a “buy,” while 29.0% recommended a “hold.” The average 12-month target price of $44.00 for Cinemark Holdings implies a 9.1% upside to its stock price on January 17.

As of January 17, the stock has gained 12.6%. In 2018, Cinemark Holdings stock rose 2.8%.