Understanding Time Warner’s Warner Bros. Revenue Trends

Time Warner’s (TWX) studio segment, Warner Bros., had a weak 1Q18, with both its revenue and operating income falling.

May 3 2018, Updated 12:26 p.m. ET

Warner Bros. falls in 1Q18

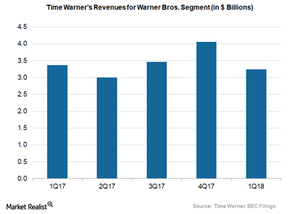

Time Warner’s (TWX) studio segment, Warner Bros., had a weak 1Q18, with both its revenue and operating income falling. In 1Q18, Warner Bros. revenue fell 4% to $3.2 billion due to tough comparisons from 1Q17. Quarter-over-quarter, the company’s revenue fell steeply after gaining growth for three quarters. Its adjusted operating income also declined significantly, by 25% to $383 million.

Revenue drivers in 1Q18

Warner Bros. revenue fell 4% in 1Q18 due to lower television and theatrical revenue. While television revenue declined due to a difficult comparison from 1Q17, theatrical revenue fell due to the mix and timing of releases.

On the positive side, the segment was boosted by currency exchange in the quarter. Gaming revenue rose in 1Q18, primarily due to carryover revenue from Golf Clash, Injustice 2, and Middle-Earth: Shadow of War.

Film releases

In 1Q17, Time Warner’s studio unit had Kong: Skull Island and The LEGO Batman Movie in theaters and signed domestic TV content licensing pacts. In 1Q18, the company released Ready Player One. Between its release on March 29 and April 24, Ready Player One grossed over $525 million at the worldwide box office. Moreover, it became Warner Bros.’ highest-grossing film in China.

So far in the 2017-2018 broadcast television season, Warner Bros. has produced half of the top ten comedies, including The Big Bang Theory, Young Sheldon, and Mom, and four of the top five non-scripted series, including The Voice, The Bachelor, and Ellen’s Game of Games. Also, 13 Warner Bros. series have been renewed for the 2018-2019 broadcast television season, including five DC Entertainment television series.

Warner Bros.’ market share

According to Box Office Mojo, Disney’s (DIS) Buena Vista Pictures topped the 2018 domestic box office with a 26.1% market share as of April 22, followed by Warner Bros., which had a 12.9% market share. Sony/Columbia (SNE), 20th Century Fox (FOXA), and Comcast’s (CMCSA) Universal Studios had market shares of 11.5%, 11.4%, 9.9%, respectively.