Behind Intel’s Gross Margin

Intel (INTC) is currently working on fixing the security flaws found in its chip designs. However, the nature of these threats is dynamic and evolving.

March 13 2018, Updated 10:30 a.m. ET

Intel’s profitability and design flaws

Intel (INTC) is currently working on fixing the security flaws found in its chip designs. However, the nature of these threats is dynamic and evolving, and this has forced Intel to update its risk factors.

Many analysts were concerned that these security threats would significantly increase its costs. However, Intel has already included the costs associated with these security issues and does not expect them to have a significant impact on its operating expenses.

Gross margin

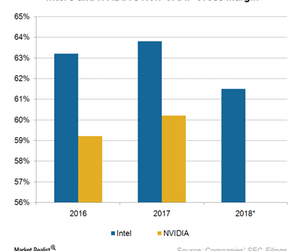

Intel’s non-GAAP (generally accepted accounting principles) gross margin rose from 63.1% in 4Q16 to 64.8% in 4Q17, as its revenue rose 4.2% YoY (year-over-year), or $700 million. Its cost of sales, however, remained almost unchanged.

The higher revenues came as a result of a higher ASP (average selling price) and units in the data center platform. Intel’s full-year gross margin rose from 63.2% in 2016 to 63.8% in 2017.

Fiscal 2018 gross margin guidance

For fiscal 2018, Intel expects its gross margins to fall to around 61.5% as it grows its adjacent businesses of FPGAs (field-programmable gate arrays) and modems. These adjacent products have a lower margin because Intel gets them manufactured from third-party foundry TSMC (TSM). Here, TSMC adds its profit margin before delivering the chips to Intel, which increases Intel’s costs.

Another factor that would impact Intel’s gross margin is the company’s transition to the 10 nm (nanometer) node. The initial production will likely be expensive, and the cost benefit from smaller node would only be realized in 2019, when the company ramps production on this node.

The higher cost of sales would partially be offset by cost benefit from the 14 nm node. However, it’s important to note that the 14 nm node has matured and delivers little cost savings. At the same time, the company doesn’t expect significant improvements in ASP in 2018, which would cover the rising cost of sales. Hence, the company has guided a lower gross margin.

But even at 61.5%, Intel’s gross margin would be in the higher end of its long-term gross margin range of 55%–65% and higher than rival NVIDIA’s (NVDA) gross margin of 60.2%.

Next, we’ll look at Intel’s expenses and operating efficiency.