American Eagle Outfitters’ Top-Line Performance in Fiscal 4Q17

Strength in the American Eagle and Aerie brands along with a robust digital business contributed to its top-line growth.

Nov. 20 2020, Updated 2:17 p.m. ET

Revenue tops estimates

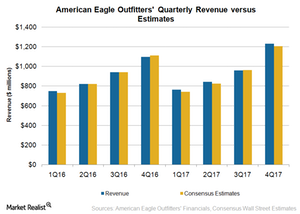

As we saw in the previous part of this series, on March 8, 2018, American Eagle Outfitters (AEO) reported fiscal 4Q17[1. Fiscal 4Q17 ended on February 3, 2018.] revenue of $1.23 billion. That easily beat analysts’ estimate of $1.21 billion and was better than $1.1 billion reported in fiscal 4Q16.

Strength in the American Eagle and Aerie brands along with a robust digital business contributed to its top-line growth. The average unit retail price rose in the low single digits due to a favorable product mix.

Revenue for its stores rose in the low single digits, and its digital platform rose 20%. Its digital revenue contributed 31% of its total revenue, with digital penetration up 340 bps (basis points) on a YoY (year-over-year) basis.

Comps rose 8%, with comps for Aerie and American Eagle increasing 34% and 5%, respectively.

American Eagle and Aerie prospects

According to the company, revenue for its American Eagle brand is now more than $3 billion, and the next $1 billion will be driven by strength in the bottoms (especially jeans) category as well as an increase in loyalty membership.

For Aerie, management is confident the brand will go over $1 billion, driven by strength in intimate apparel and categories such as accessories, fleece, swimwear, and leggings. The company remains focused on developing innovative products to boost the brand’s top line. Aerie’s focus on bralettes has been a key catalyst for its success since Millennials are a comfort-conscious demographic. Also, the company’s decision to hire plus-sized models, including Iskra Lawrence, Aly Raisman, Yara Shahidi, and Rachel Platten, has resonated with the masses, and its decision not to photoshop models has been a masterstroke.

For both brands, the company is overhauling stores and improving customer experience to drive revenue.

Peers’ holiday quarter performances

Urban Outfitters (URBN) reported fiscal 4Q18 net sales of $1.09 billion, which was a 5.7% rise from fiscal 4Q17. It beat analysts’ estimate of $1.08 billion. The company’s strong top-line performance was driven by positive comps growth across all its brands, namely Free People, Anthropologie, and Urban Outfitters.

Abercrombie & Fitch (ANF) reported fiscal 4Q17 sales of $1.19 billion, which topped analysts’ projection of $1.16 billion and rose 15.1% on a YoY basis. Strength in the Hollister brand, international operations, and DTC (direct-to-consumer) sales has been the main catalyst.