FireEye’s Value Proposition in the Cybersecurity Space

Cisco Systems is considered a leader in security appliances, but IDC recently stated that Palo Alto, with its 17.1% market share, leads the security market.

Feb. 3 2017, Updated 9:06 a.m. ET

FireEye’s scale in cybersecurity

Previously in this series, we discussed FireEye’s (FEYE) recent offerings and the company’s focus on SaaS (software-as-a-service) to generate revenue growth. In this part, we’ll look at FireEye’s value proposition among select US cybersecurity companies.

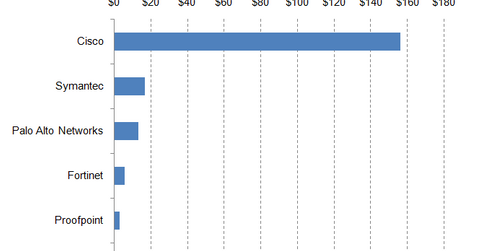

On January 30, 2017, Cisco Systems (CSCO) was the largest global player by market capitalization in the security space. Cisco Systems (CSCO) is considered a leader in the overall security appliance market, but IDC recently stated that Palo Alto, with its 17.1% market share, currently leads the security market.

Symantec (SYMC), Palo Alto Networks (PANW), FireEye, Barracuda (CUDA), and Fortinet (FTNT) join Cisco at the top of cybersecurity.

FireEye’s enterprise value multiples

Now let’s look at the EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples of FireEye’s peers. FireEye has a negative EBITDA, so we haven’t included it here.

The forward EV-to-EBITDA multiple for Palo Alto Networks most recently stood at ~28.81x. Cisco Systems had a multiple of ~7.07x, and Symantec had a multiple of 11.5x on November 29, 2016.

FireEye’s dividend yield

Cisco Systems’ forward annual dividend yield was ~2.3% on January 30, 2017, which was higher than Symantec’s forward annual dividend yield of ~1.1%. But most of the companies in cybersecurity are relatively new, which is why most of them don’t pay dividends. These companies include Palo Alto Networks, FireEye, and Fortinet.

In the next and final part of this series, we’ll see what analysts are recommending for FireEye.