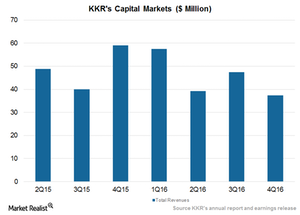

KKR’s Capital Markets Segment Was Subdued amid Lower Activity

KKR’s (KKR) Capital Markets and Principal Activities segment complements its activities in both private and public markets.

March 9 2017, Updated 12:35 p.m. ET

M&A and transactions

KKR’s (KKR) Capital Markets and Principal Activities segment complements its activities in both private and public markets. The division saw subdued revenues of $37 million in 4Q16 as compared to $59 million in 4Q15 and $47 million in 3Q16, reflecting declining activity on the advisory front.

In 4Q16, activity in mergers and acquisitions and funding fell due to investors holding positions, new investments, and fewer exits.

KKR’s Capital Markets segment advises its portfolio companies as well as other corporate clients on capital market transactions. The division manages equity and debt financing for companies, places and underwrites securities offerings, and manages other capital market offerings. KKR earns underwriting fees for executing these transactions.

KKR’s total AUM (assets under management) stood at $130 billion in 4Q16. KKR’s competitors’ AUMs are as follows:

- Carlyle Group (CG): $155 billion

- Blackstone Group (BX): $356 billion

- Apollo Global Management (APO): $161 billion

Together, these companies make up 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).

Volatility can rise

In 1Q17, KKR can see higher transaction activity backed by volatility, rising broad markets, and profit booking or realizations on selective investments. The division could benefit from increased volatility due to rate expectations. In 4Q16, the segment saw a 30% contribution from third party clients, and 35% of the total fees came from outside of the US. The trend of getting more business from portfolio companies continued in 4Q16, reflecting a high correlation of transaction fees to portfolio performance.

In the next part of the series, we’ll study KKR’s realizations and distributions amid a volatile operating performance in 2017.