Will American Tower Ride High on Its Top Line in 2Q17?

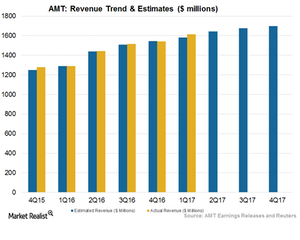

Analysts expect wireless tower operator American Tower (AMT) to report revenue of $1.6 billion in its 2Q17 earnings call on July 27, 2017.

July 19 2017, Updated 1:05 p.m. ET

Revenue in 2Q17

Analysts expect wireless tower operator American Tower (AMT) to report revenue of $1.6 billion in its 2Q17 earnings call on July 27, 2017.

The company’s revenue is expected to remain almost flat for the quarter at a rise of just 0.1% year-over-year (or YoY). The positive effects of its higher tenant billing are expected to be offset by higher churn rates owing to industry consolidation. Further, a secular shift of carriers toward small cells could affect wireless towers such as AMT negatively.

The company is expected to report revenue of $6.6 billion in 2017, flat YoY. AMT’s high towers, which exceed 800 feet, provide sufficient space for multiple tenants, allowing it to generate robust revenue growth.

US segment expected to drive growth in 2Q17

American Tower’s US Property segment reported robust growth of 5% on the back of 6.5% growth in its organic tenant billings. A healthy demand environment and the company’s recently signed master lease agreements are expected to drive its revenue growth in 2Q17 as well.

International segment is also on the upside

AMT’s revenue growth is also expected to be backed by its international organic tenant billings, which exhibited a rise of more than 14% during 1Q17. AMT also entered several joint ventures with other countries in the quarter. A sharp rise in Smartphone penetration in several developing countries is also expected to help the company report higher revenue in the quarter.

1Q17 signified a strong start to 2017

During 1Q17, American Tower reported a revenue rise of 26% to $1.6 billion, backed by a 22% rise in its tenant billings business and an 8.6% rise in its organic tenant billings business. Its revenue surpassed analysts’ estimates by 2.1% in the quarter.

Wall Street expects American Tower’s close peers Simon Property Group (SPG), SBA Communications (SBAC), and Crown Castle International (CCI) to report revenues of $300 million, $425.7 million, and $1.0 billion, respectively, in 2Q17.

The ProShares Ultra Real Estate ETF (URE) holds almost 17% in AMT and its peers. The ETF is diverse in terms of both geography and products, so it offers a cushion to investors.