How Telecom Industry Ownership Could Affect American Tower

Under the leadership of Ajit Pai and Jeffrey Eisenach, the FCC is expected to unblock several stalled deals as well as pave the way for some new deals.

June 13 2017, Updated 10:36 a.m. ET

Trump administration raises hopes for mergers

A series of political and industrial issues have led to apprehension regarding M&A activity in the telecom industry in the next few months. Some market analysts believe that under the pro-merger Federal Communications Commission (or FCC) leadership, there could be a frenzy of deals among telecom giants that could lead to an industry consolidation.

The Trump administration has boosted confidence in the industry by portraying itself as a deal-friendly administration. Under the leadership of Ajit Pai and Jeffrey Eisenach, the FCC is expected to unblock several stalled deals as well as pave the way for some new deals.

Once the temporary ban on deal talks is removed, market analysts believe there could be a series of deals among the major industry players.

Potential mergers in the domestic market

Telecom company stocks are already doing well under the Trump administration’s light regulatory environment. Among the deals that are in the pipeline, the T-Mobile (TMUS) and Sprint (S) deal could materialize soon.

Also, Verizon’s (VZ) takeover bid for Yahoo! and AT&T’s (T) merger deal with Time-Warner Cable are among the deals in the pipeline. Market analysts believe that in the current environment of loosening regulations and free play, additional deals could surface in the near term.

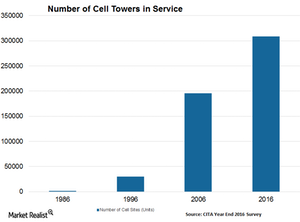

The chart above shows the cell sites that have been in service in the US in the last two decades.

Consolidation in the Indian telecom industry

In the international market, there has been major consolidation going on the telecom industry. In India, the second- and third-largest telecom service providers—Vodafone and Idea—have announced their plans to merge.

Reliance Communications Ltd. announced its intention to merge with Aircel, which would form a telecom operator ranked fourth by customer base in the country.

How does consolidation affect AMT’s profits?

With the ongoing consolidation in the telecom industry, cell tower owners like American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) have been experiencing some jitters. Because tower owners earn revenues from their tenants such as mobile service providers, consolidation results in a shrinking customer base and a higher churn rate.

Also, integrated networks have left several towers unused. The chart shows the increase in towers built over the past two decades.

Industry trends

However, American Tower is optimistic about the ongoing trend in the industry. AMT’s management believes that the consolidation and market rationalization process, especially in India, is only a short-term headwind. AMT believes this trend could result in a positive long-term structural measure for the market, particularly when well-capitalized tenants can support the industry and encourage competition.

AMT garners its funds from operations and the tenant billing outlook for fiscal 2017. Its revised outlook includes a 2% gain, which reflects strong demand for tower space arising from new business startups in India. This outlook shows that AMT isn’t expected to be affected negatively by the consolidation resulting from the industry’s mergers and acquisitions.

American Tower, Crown Castle, and Simon Property constitute 17% of the PowerShares Active US Real Estate ETF (PSR).

In the next article, we’ll see how AMT rewards its shareholders.