Crown Castle on the Street: Inside the Analyst Ratings

Analysts have given CCI a mean price target of $106.83, implying a rise of 7.1% from its current level of $99.75.

July 3 2017, Updated 7:36 a.m. ET

CCI’s analyst ratings

Crown Castle International’s (CCI) future performance expectations in 2017 are reflected in its analyst ratings. Analysts have given CCI a mean price target of $106.83, implying a rise of 7.1% from its current level of $99.75.

CCI’s business momentum has been backed by several acquisitions and strategic partnerships aimed at boosting its presence in the futuristic 5G (fifth-generation) spectrum band and small-cell network. These factors could have caused analysts to become optimistic about the future of the stock. The company’s higher funds from operations and revenue guidance for fiscal 2017 also likely triggered confidence among analysts.

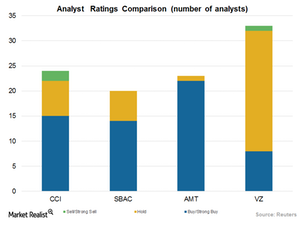

Of the 22 analysts covering CCI stock, 15 have issued “buy” or “strong buy” ratings. While seven analysts gave CCI a “hold” rating, two analysts have rated the stock as a “sell” or “strong sell.” Compared to the ratings issued in March 2016, CCI’s number of “strong buy” and “buy” ratings has remained at 15.

CCI’s peer ratings

Among CCI’s major peers, 14 of 20 analysts covering SBA Communications (SBAC) have given it a “buy” or “strong buy” rating. Six analysts have given SPG a “hold” rating.

Of the 23 analysts covering American Tower (AMT), 22 have given the stock a “buy” or “strong buy” rating, while one analyst has given AMT a “hold” rating.

Eight of 33 analysts have given Verizon Communications (VZ) a “buy” or “strong buy” rating. While 24 analysts have given VZ a “hold” rating, only one analyst has given it a “sell” or “strong sell” rating.”

Notably, American Tower and Crown Castle together make up 11.5% of the PowerShares Active US Real Estate ETF (PSR).