5G Is the Future of Internet Data—Is It a Threat to AMT?

More than 95% of AMT’s towers are located in suburban and rural areas, where the majority of the US population resides.

June 13 2017, Updated 9:06 a.m. ET

IoT and smartphones

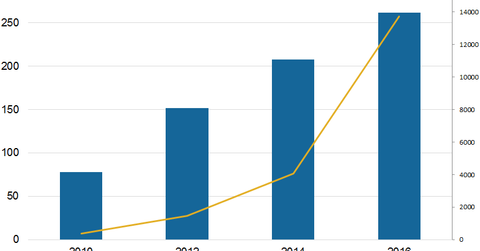

Most wireless service providers currently operate on 4G networks. However, the rapid expansion of the Internet of Things (or IoT) has been pressuring network performance. The active use of smartphones has risen 15% over the past seven years. The graph below shows the number of smartphones in active use in the US since their introduction in 2009.

To meet consumer and business demand for improved performance, wireless providers are working on providing high-speed Internet data with 5G, or fifth-generation, technology in the coming years.

Some market analysts have expressed concern that when 5G hits the market, the sites can be mounted on utility poles, street lights, and other public locations. Currently, wireless companies use traditional cell phone towers.

This shift can pose a threat to wireless tower owners like American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC), as 5G Internet data requires small cells that are accessible via fiber. Plus, 5G Internet data is expected to use frequencies up to 100 GHz, which supports high-resolution 8K video.

How could competitors react?

In order to tap future digital opportunities, AMT’s competitors such as Crown Castle (CCI) are investing in 5G technology. The company is making an effort to double its small cell deployment in the next two years.

Crown Castle has taken over small cell operator Sunesys, which added 16,000 miles of metro fiber and a DAS/small cell portfolio of 15,000 nodes to Crown Castle’s portfolio.

American Tower’s stance on 5G

However, American Tower (AMT) doesn’t consider small cells to be a competitive threat to its cell towers. AMT considers small cells to be complementary to its towers, especially in densely populated urban areas where the company has about 5% of its towers.

More than 95% of AMT’s towers are located in suburban and rural areas, where the majority of the US population resides. The suburban and rural populations are not as dense as in the cities.

However, in these areas, the 5G network as currently envisioned isn’t viable because of the high-band spectrum required for 5G. These spectrums work on small cell architectures with a short-range propagation radius, which is not as effective over a large area.

Long-term tower leases

Because AMT’s towers are leased until 2020, it believes that 5G shouldn’t be a viable solution in the rural and suburban regions by then. The 5G networks are effective only in densely populated regions and work within a small distance.

On the other hand, wireless carriers in rural areas and suburban regions use the low-band spectrum, which is the most cost-effective and technologically effective way to cover these regions.

The PowerShares Active US Real Estate ETF (PSR) has a market cap–weighted index that covers specialized, residential, and commercial REITs. American Tower, Simon Property Group (SPG), and Crown Castle International (CCI) constitute 17% of PSR’s portfolio.

In the next article, we’ll see how consolidation and mergers in the telecom industry affect AMT.