How Apple Has Contributed to Green Bonds

Apple (IYW) (XLK) is not only the first US technology company but also the first and largest US corporation to issue green bonds.

May 31 2017, Published 11:42 a.m. ET

VanEck

KEMMERER: ESG investing has certainly moved from a niche to a mainstream strategy. One of the things that exemplifies this trend is Apple’s recently issued green bond, tell us more about that?

LOPEZ: Yes, it is really cool, given that Apple is a corporation, and not a sovereign player or a supranational. Corporations get involved in green bonds perhaps out of reputation, perhaps out of their own interest, or perhaps out of client interest. But corporations are definitely getting involved. Apple is one of the most notable ones and last year it issued a $1.5 billion green bond. As part of the Green Bond Principles, reporting is one of the main principles. Apple recently published its annual report on its Green Bond issue [Annual Green Bond Impact Report], and reported on what they had spent money on in 2016. This included $422 million across a variety of projects, for instance, one was on energy efficiency. Apple’s headquarters in Cupertino will be powered 100% by renewable energy. Your FaceTime, iChat, and Messenger apps and the cloud system, for example, are all powered by a solar farm. One of the coolest projects Apple has developed is a line of robots called “Liam”, which disassemble iPhones at the rate of 1.2 million iPhone 6s a year. Liam helps retrieve and save certain key materials like rare metals or aluminum or gold, so they can be reused and then don’t have to be mined out of the earth.

Market Realist

Apple leads the way

Apple (IYW) (XLK) is not only the first US technology company but also the first and largest US corporation to issue green bonds (GRNB). The company’s green bond issue aims to reduce climate change hazards through the adoption of renewable sources of energy and driving its energy efficiency, usage of safer materials, and preservation of precious resources.

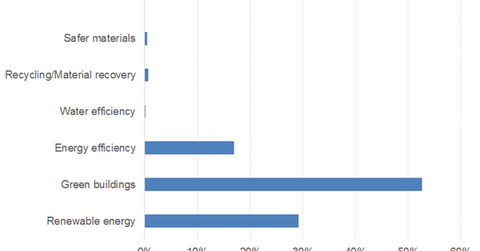

Apple has earmarked more than 50.0% of its green bond fund toward green buildings. It has ensured a substantial proportion of the fund toward renewable energy and energy efficiency, all of which you can see in the above graph. The 16 projects that have been allocated to the green bond fund is expected to contribute to the following:

- green buildings of 1.9 million square feet

- annual water savings of 20.2 million gallons

- generation of renewable energy of 330.5 million kWh (kilowatt hours)

- annual energy savings of 37.0 million kWh plus 0.03 million therms

- annual prevention of greenhouse gas emissions of 0.20 million metric tons CO2e (carbon dioxide equivalent)

- waste diversion of 6,670 metric tons from landfills

- fresh installation of renewable energy capacity of 127 MW (megawatts)

- Apple’s green bond issue will play a key role in driving awareness regarding how to remain at the top of the game by ensuring the reduction of universal emissions.

Barriers to the bonds

Apple, the technology giant, has set an example at a time when concerns loom over President Trump’s view of climate change, his apparent preference for non-renewable energy sources, and his possible withdrawal from the Paris Agreement. The Clean Power Plan, enacted during the Obama administration, which aims to reduce carbon dioxide emissions, may become the target of change by the Trump administration. There is also a need to devise and strategize uniform reporting and disclosure practices for the green bond market.