What Analysts Think about Praxair

As of March 14, 2017, 21 brokerage firms were tracking Praxair (PX) stock actively.

March 15 2017, Updated 10:38 a.m. ET

Analysts’ recommendations for Praxair

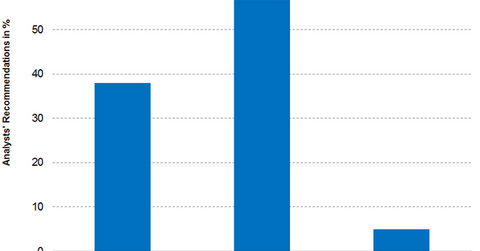

As of March 14, 2017, 21 brokerage firms were tracking Praxair (PX) stock actively. 38% of these analysts have recommended the stock as a “buy,” 57% of the analysts have recommended the stock as a “hold,” while the remaining 5% of analysts have recommended the stock as a “sell.”

The analyst consensus indicates the 12-month target price for Praxair to be at $127.72, which implies a return potential of 9.4% from its closing price of $116.72 on March 14, 2017.

Why most analysts recommend a “buy” or “hold”

Praxair met analyst 4Q16 expectations and signed some long-term contracts with clients that could increase its revenue. These achievements could have encouraged analysts to recommend a “buy” or “hold” for Praxair.

Recommendations and targets from well-known brokerage firms

- On February 14, 2017, Evercore ISI rated Praxair as a “sell” with a target price of $107, which implies a 12-month potential return of -8.3% compared to the March 13, 2017, closing price of $116.72.

- On January 27, 2017, Baird rated Praxair as “neutral” with a target price of $127, which implies a 12-month potential return of 8.8% compared to the March 13, 2017, closing price of $116.72.

Investors can indirectly hold Praxair by investing in the ProShares Ultra Basic Materials (UYM), which invests 4.1% of its portfolio in Praxair. The top holdings of this fund include Dow Chemical (DOW), DuPont (DD), and Monsanto (MON), which have weights of 8.8%, 8.6%, and 6.1%, respectively, as of March 13, 2017.