What are the Valuation metrics for Dish?

Valuation metrics In this part of the series, we’ll look at some key metrics investors can use to compare the values of media companies. Specifically, we’ll look at media valuation multiples. Some valuation metrics include the PE (price-to-earnings), EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), PCF (price-to-cash flow), and PFCF (price-to-free […]

July 22 2016, Updated 9:06 a.m. ET

Valuation metrics

In this part of the series, we’ll look at some key metrics investors can use to compare the values of media companies. Specifically, we’ll look at media valuation multiples.

Some valuation metrics include the PE (price-to-earnings), EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), PCF (price-to-cash flow), and PFCF (price-to-free cash flow) multiples.

Price-based multiples measure value from a shareholder’s perspective. Enterprise value–based multiples help investors understand a company’s value from the perspective of the holders of its sources of capital. These are forward multiples based on the expected value of the denominator after a year.

Is Dish undervalued?

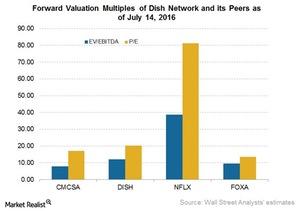

As the graph above indicates, Dish Network (DISH) has a forward EV-to-EBITDA multiple of 11.8x and a PE multiple of 20.3x. In contrast, Netflix (NFLX) has a forward EV-to-EBITDA multiple of 38.7x and a PE multiple of 81.3x.

Peers 21st Century Fox (FOXA), and Comcast (CMCSA) have forward EV-to-EBITDA multiples of 9.5x and 7.7x, respectively. In the peer group, Netflix has the highest forward PE multiple, with 81.3x. Based on its forward EV-to-EBITDA multiple, it appears Dish is undervalued compared with its peers.

Dish’s value proposition

It remains to be seen whether Dish’s pay-TV subscriber base will be boosted by the new version of Sling TV in the coming quarters. Considering the rising competition from OTT (over-the-top) operators like Netflix, it remains to be seen whether the new version of Sling TV would be successful. Another point in favour of Dish is its wireless spectrum that is a valuable asset for the company.