KKR Capital Markets Manages Higher Revenues on Deal Making

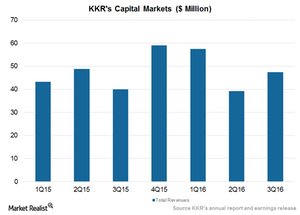

KKR’s Capital Markets and Principal Activities segment saw revenues of $47 million in 3Q16, as compared to $40 million in 3Q15 and $39 million in 2Q16.

Nov. 24 2016, Updated 10:04 a.m. ET

Market activity

KKR & Company’s (KKR) Capital Markets and Principal Activities segment’s performance complements its activities in both private and public markets. The division saw revenues of $47 million in 3Q16, as compared to $40 million in 3Q15 and $39 million in 2Q16, reflecting improved activity on the advisory front.

In 3Q16, activity in mergers and acquisitions and funding rose due to liquidity, the broader market’s strong performance, and portfolio building from alternatives.

KKR’s Capital Markets segment advises its invested and third-party companies on capital market solutions. Its services include arranging equity and debt financing for transactions, placing and underwriting securities offerings, and managing other capital market services. KKR earns agency or underwriting fees for resulting these transactions.

KKR’s total AUM (assets under management) stood at $131.1 billion in 3Q16. KKR’s competitors’ AUMs are as follows:

- Carlyle Group (CG): $193 billion

- Blackstone Group (BX): $333 billion

- Apollo Global Management (APO): $163 billion

Together, these companies make up 4.3% of the PowerShares Global Listed Private Equity ETF (PSP).

Volatile macro environment

KKR’s Capital Markets segment helps the company access equity and debt capital directly for its clients and provides a boost in volatile markets. In 3Q16, the segment saw a rise in third-party deals as markets rose and companies took advantage of cheap capital availability. Overall, equity markets were strong in the quarter, both inside and outside the US.

KKR generates almost half of the Capital Markets segment’s revenue from its investee companies. The company uses the division to help in profitable deal making for its clients.