A Look at Netflix’s Capital Structure

Netflix was asked about its target capital structure at the Goldman Sachs Communacopia Conference last month. It said it believes it was underleveraged.

Oct. 14 2016, Updated 11:04 a.m. ET

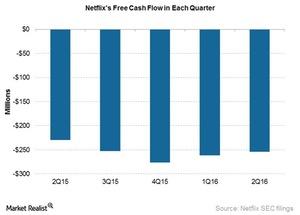

Negative free cash flow

Netflix (NFLX) had free cash flow of -$254 million in fiscal 2Q16 compared to -$229 million in fiscal 2Q15. The company has indicated that it plans to raise debt of around $2 billion later this year or early in 2017.

Netflix had cash of $1.8 billion on its balance sheet at the end of fiscal 2Q16 and gross debt of $2.4 billion. The company’s ratio of content cash to profit and loss expense is 1.3–1.4. It expects this ratio to peak to 1.4 but doesn’t expect to exceed that. It expects to generate free cash flow of around -$1 billion in 2016.

Target capital structure

Netflix was asked about its target capital structure at the Goldman Sachs Communacopia Conference last month. The company said it believes it was underleveraged from an optimal capital–cost to capital structure. It further explained that its peers in the media sector were more leveraged and that it still has room to take on more debt.

Netflix added that when it comes to its bonds, “they’re actually trading one to two grades better than our rating. So, I think that’s the market acknowledging that Netflix is a strategic asset. If there is any most of that debt is especially in a high yield situation is priced off of what if distress situation so, if you look at our interest coverage, if you look at the back that would be in any distress situation, a desired asset.”

It’s important to note here that the company has a low debt-to-market capitalization ratio, which indicates that it has less debt than its market value.