Alternatives Are Sitting on Record Capital, Making Investments

In 2015, fund managers took advantage of lower valuations and the availability of a record dry powder in order to make fresh investments at lower valuations.

Oct. 6 2016, Updated 5:04 p.m. ET

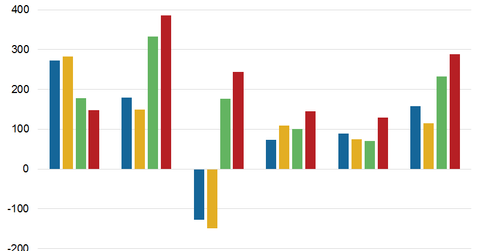

Investments rise

In 2015, alternative asset managers couldn’t liquidate or book profits at a faster pace in the midst of a strong fall in commodity prices. Fund managers took advantage of lower valuations and the availability of a record dry powder in order to make fresh investments at lower valuations.

Blackstone Group (BX), the world’s largest alternative manager, invested $1.6 billion during the June 2016 quarter, mainly in private stakes. These deployments included new investments as well as add-on stake purchases in strong platforms.

The company has been aggressive in terms of new purchases and increasing stakes in existing buyouts. However, since valuations rose substantially after the Brexit vote, the company is expected to see subdued deployments.

Investments for Carlyle and KKR

KKR’s (KKR) investments rose in the last quarter of 2015 and the first half of 2016. However, its revenues fell to $544 million in the June 2016 quarter compared to $1.2 billion in the prior year’s quarter. The company has substantial unrealized investment losses, mainly in holdings in the energy and natural resource space.

KKR’s total AUM (assets under management) is $131 billion. Let’s compare that to the AUM for KKR’s peers:

- Carlyle Group (CG): $193 billion

- Blackstone Group (BX): $333 billion

- BlackRock (BLK): $4.5 trillion

- Apollo Global Management (APO): $163 billion

Together, these companies form 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).

Carlyle has continued to manage funds alongside strong dry powder of $55.1 billion as of June 30, 2016. The company is going slowly on major allocations until some of the unrealized losses diminish amid rising commodity prices. Carlyle’s dry powder includes $20.6 billion in corporate private equity, $14.8 billion in investment solutions, $14.5 billion in real assets, and $5.3 billion in Global Market Strategies.

Now let’s look at the real estate performances of various alternatives.