How Does Twitter Compare with Its Peers?

Twitter trades at lower multiples than its peers Earlier in this series, we discussed rumors of Twitter’s (TWTR) possible acquisition and how Salesforce (CRM), Google (GOOG), and The Walt Disney Company (DIS) could be contenders. In this part, we’ll compare Twitter’s value proposition with that of other companies in the social media space. As of […]

Oct. 5 2016, Updated 8:04 a.m. ET

Twitter trades at lower multiples than its peers

Earlier in this series, we discussed rumors of Twitter’s (TWTR) possible acquisition and how Salesforce (CRM), Google (GOOG), and The Walt Disney Company (DIS) could be contenders. In this part, we’ll compare Twitter’s value proposition with that of other companies in the social media space.

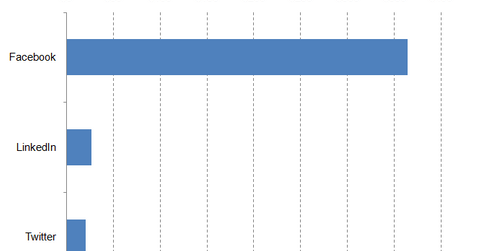

As of September 27, 2016, Facebook (FB) was the largest social media company by market capitalization, as the above chart shows. Twitter remains the smallest, even lagging behind LinkedIn (LNKD), which has been acquired by Microsoft (MSFT).

Twitter’s valuation multiples

Twitter’s key valuation multiple is the EV (enterprise value)-to-sales multiple. As of September 27, 2016, Twitter was trading at an EV-to-sales multiple of 5.8x. This metric was lower than Facebook’s 15.6x and LinkedIn’s 6.9x.

In general, a lower EV-to-sales multiple indicates that a stock is undervalued and could be a good investment opportunity. However, a lower multiple isn’t always good. Whereas Facebook’s high multiple is warranted thanks to its high growth rate, Twitter has the lowest growth forecast among the lot.

In fiscal 2Q16, Twitter witnessed the slowest growth in its top line since it went public, as we discussed earlier in this series. 2Q16 also marked the eighth straight quarter of falling growth. The company’s uptake among younger users remains poor compared with the uptake of Snapchat and Facebook’s Instagram. Advertisers are shying away from its platform, as demonstrated by its revenue growth rate.

Therefore, considering that its growth is falling steadily and that it’s losing out to peers in social media space, Twitter’s lower multiple is justified.