Netflix’s Capital Structure: What You Need to Know

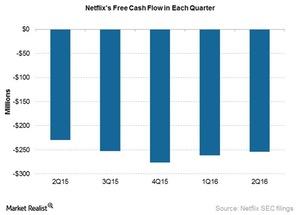

Netflix (NFLX) had a negative free cash flow of -$254 million in fiscal 2Q16 compared to -$229 million in fiscal 2Q15.

Aug. 2 2016, Updated 11:04 a.m. ET

Negative free cash flow

Netflix (NFLX) had a negative free cash flow of -$254 million in fiscal 2Q16 compared to -$229 million in fiscal 2Q15. The company has indicated that it plans to raise debt of around $2 billion later this year or early in 2017.

Netflix had cash of $1.8 billion on its balance sheet at the end of fiscal 2Q16 and gross debt of $2.4 billion. The company’s ratio of content cash to profit and loss expense is in the range of 1.3-1.4. Netflix expects this ratio to peak to 1.4 but does not expect to exceed it. The company expects to generate a negative free cash flow of around $1 billion in 2016.

Why is Netflix burning cash?

Netflix’s increasing capital requirements are fueled by its increasing focus on original programming because the production of original programming requires more cash upfront than the acquisition of licensed content. Netflix stated in its fiscal 2Q16 earnings letter to shareholders that it perceives original programming to provide many benefits to the company, including “exclusivity, greater creative and business control, global rights and brand halo.”

The company also believes its expenditure on original programming will continue to weigh on its free cash flow metric even after it’s profitable globally.

It’s important to note here that the company has a low debt-to-market capitalization ratio, which indicates that it has less debt than its market value.