What’s the Key to The Fresh Market’s Profitability?

Compared with other food retail chains, The Fresh Market’s performance in terms of profitability has been best-in-class.

Feb. 25 2016, Updated 11:04 a.m. ET

A look at TFM’s profitability

The Fresh Market (TFM) generated a net profit of $63 million during fiscal 2015 (year ended January 25, 2015). The company’s net income grew at a compounded annual growth rate of 7% between 2012 and 2015, while its average net margin has been around 4% during the last three years.

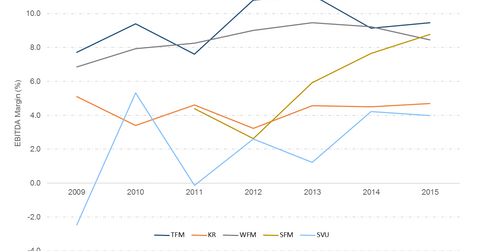

Comparing profitability to peers’

Compared with other food retail chains, the company’s performance in terms of profitability has been best-in-class. The Fresh Market’s (TFM) average five-year EBITDA (earnings before interest, tax, depreciation, and amortization) margin stands at 9.6%. This is higher than Whole Foods Market’s (WFM) average EBITDA margin of around 9%, Sprouts Farmer Market’s (SFM) 6%, and Kroger’s (KR) 4.3%.

The year-end dates for the above retailers are as follows:

- The Fresh Market: January 25, 2015

- Kroger: January 31, 2015

- Whole Foods Market: September 27, 2015

- Sprouts Farmers Market: December 28, 2014

- SuperValu: February 28, 2015

Small-box format a key to high margins

The company believes having a smaller-box format with fewer SKUs (stock-keeping units) than other conventional supermarkets has proven to be highly profitable. Whereas TFM’s stores are an average of 21,000 square feet and carry approximately 10,000 to 11,000 SKUs, conventional supermarkets are approximately 40,000 to 60,000 square feet in size and carry an average of 45,000 SKUs. Its smaller-box format has helped the company focus on higher-margin food categories, which has led to higher profitability.

It should be noted that although TFM has higher margins than its peers, its margins have come under pressure as a result of increasing competition in the food retail space. The company’s EBITDA margin, which stood at 11% in fiscal 2013, fell to less than 8% in the most recent quarter (quarter ended October 2015).