A Closer Look at the Highly Competitive Organic Food Industry

With the increasing focus on health and wellness, the organic food channel has grown at more than twice the pace of the conventional food channel.

Dec. 29 2015, Updated 8:05 a.m. ET

Organic food industry grows with health consciousness

With the increasing focus of customers on improving their health and wellness, organic food has become a big seller in today’s food industry. According to the Progressive Grocer’s report, the natural food channel has been growing at more than twice the pace of the conventional channel.

Organic products are now sold not just by specialty stores but also by mass merchandisers and traditional supermarkets. According to a 2014 US Department of Agriculture study, three out of four conventional grocery stores now carry organic goods, and more than 80% of US families buy organic products today. This has resulted in the rise in the sale of organic products. According to the Organic Trade Association, US sales of organic foods and nonfoods stood at nearly $40 billion in 2014.

Sprouts still small in front of competition

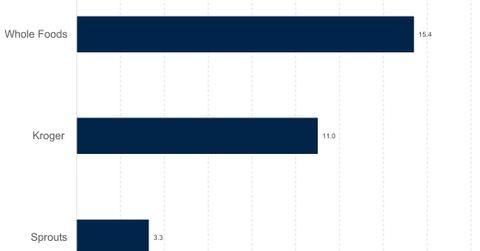

As an organic and natural food retailer, Sprouts Farmers Market faces direct competition from Whole Foods Market (WFM), which is the dominant player in the organic food industry. There has also been a constant increase in competition in the organic food space by mass merchandisers such as Wal-Mart Stores (WMT) and Costco Wholesale Corporation (COST) as well as by supermarket chains such as Kroger Company (KR), who are increasing their offering of organic products to meet the rising demand.

Kroger is estimated to have sold more than $11 billion in natural and organic products during the past 12 months, making it the second-biggest retailer of such products in the US (according to Kroger’s investor conference in October 2015), surpassed only by Whole Foods Market. Sprouts, on the other hand, had total sales of $3.3 billion during the past 12 months, which makes it a considerably smaller player in the segment.

ETF exposure

Investors looking for exposure to organic food companies in particular and food retailers in general can invest in the SPDR S&P Retail ETF (XRT), which invests 4.3% of its total portfolio in Sprouts Farmer Market (SFM), Kroger Company (KR), Costco Wholesale Corporation (COST), and Whole Foods Market (WFM) combined.

Continue to the next part of this series for a look at Sprouts’ online grocery segment.