How Does 3M’s Dividend Yield Curve Look?

3M has recorded a 3.0% revenue growth in the first half of 2017, driven by growth in every segment and flat growth in the consumer segment.

Sept. 20 2017, Published 11:09 a.m. ET

A look at 3M’s revenue and earnings

Let’s look now at 3M (MMM), an MNC (multinational corporation) conglomerate functioning globally. 3M noted a 1.0% fall in 2016 net sales compared to 5.0% for 2015. That was due to growth posted by the industrial, safety, and graphics; healthcare; and consumer segments. Every segment, including electronics and energy, fell in 2015. Operating income posted a 4.0% growth in 2016 after a 3.0% fall in 2015. That was due to the decline in operating expenses, offset by the revenue performance. Diluted EPS (earnings per share) recorded an 8.0% growth in 2016 compared to 1.0% in 2015, despite increasing interest expenses. EPS growth was also supported by share buybacks.

3M has recorded a 3.0% revenue growth in the first half of 2017, driven by growth in every segment and flat growth in the consumer segment. Operating income posted an 8.0% growth, despite higher operating expenses due to higher gains on the sale of businesses. Diluted EPS posted a 15.0% growth despite higher interest expenses. EPS growth was also supported by share buybacks. The company has maintained an impressive free cash flow balance.

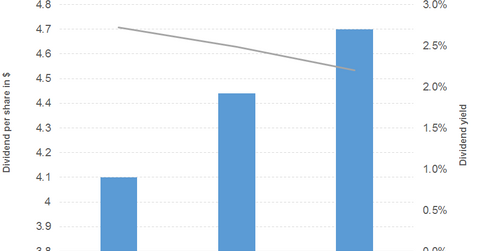

3M’s dividend trajectory

3M’s dividend yield curve has recorded a downward path despite the dividend increase. That’s due to rising prices, as shown in the chart below. However, the dividend yield hasn’t fallen below the 2.0% mark yet.

Let’s look at two dividend ETFs with exposure to 3M. The Schwab US Dividend Equity ETF (SCHD) offers a 2.8% dividend yield at a PE (price-to-earnings) multiple of 20.3x. It has a 23.0% exposure to consumer non-cyclical and a 22.0% exposure to technology. The Guggenheim Dow Jones Industrial Average Dividend ETF (DJD) offers a 2.7% dividend yield at a PE multiple of 20.9x. It has a 20.0% exposure to industrials and an 18.0% exposure to technology.