The Carlyle Group Provides Healthy Compensation to Retain Talent

The Carlyle Group’s (CG) private equity business derives value from the effective management of its operating companies as well as the returns generated for its unitholders or limited partners.

Sept. 25 2015, Updated 11:07 a.m. ET

Compensation and benefits

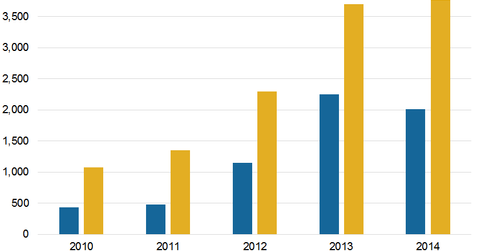

The Carlyle Group’s (CG) private equity business derives value from the effective management of its operating companies as well as the returns generated for its unitholders or limited partners. As a result, the majority of the company’s expenditures relate to compensation and benefits for its fund managing teams. Compensation and benefits include basic compensation and performance fees. Basic compensation includes salaries, bonuses, and equity-based rewards to senior managing directors and other employees.

Performance fees, on the other hand, include incentive fee allocations to senior managing directors’ and selected employees’ part of the profit-sharing incentives. The Carlyle Group allocates up to 45% of its carried interest or performance fees income towards its senior employees or fund managers.

Over the past couple of years, the Carlyle Group (CG) spent an average of 51% of its revenues on compensation and benefits. The firm’s other operating expenses amount to around 30%–40% of total revenues.

Carlyle’s compensation costs are competitive when compared with other players in the alternative asset management industry.

Performance drives compensation

Compensation is more based on the total of funds under management. Performance fees or benefits are based on the performance of investment funds. Carlyle’s performance fees declined in 2014 due to less performing energy-related investments.

Carlyle’s focus is on retaining talent across industries in order to efficiently operate the portfolio companies. In this way, it improves the operational performance of its holding companies. To do so, the company must maintain dynamic and high-performance pay structures. As performance and scale improve, compensation costs are expected on the whole to increase but remain in the 50%-to-55% range of total revenues.