Exploring revenue and profitability drivers at Disney

For the fiscal year ended September 28, 2013, the company reported record results, with an 8% increase in diluted EPS, to $3.38 compared to $3.13 in the prior year.

Jan. 8 2014, Published 5:47 p.m. ET

Disney’s growth

Disney operates in the consumer discretionary sector, and with the exception of 2009, when it was impacted by recession and management changes, it has shown consistent growth in the last four years. In the graph we’ve included here on Disney’s sales and EBITDA growth, you can see that the top-line growth increased 7% in 2013 on the back of growth in its parks and resorts and interactive segments. However, EBITDA growth contracted to 7.3% in 2013 compared to 2012.

For the fiscal year ended September 28, 2013, the company reported record results, with an 8% increase in diluted EPS, to $3.38 compared to $3.13 in the prior year. Revenues for the year increased 7%, to a record $45.0 billion, while net income increased 8%, to $6.1 billion. The Media Networks segment accounted for 45% of the company’s revenue, followed by Parks and Resorts with 31%.

In the graph below on Disney’s profitability, you can see that the company’s gross margin has slightly increased from 22.2% in 2010 to 25.8% in 2013. The margin has been almost flat for the last two years. The company’s EBITDA margin has also remained flat in the last two years.

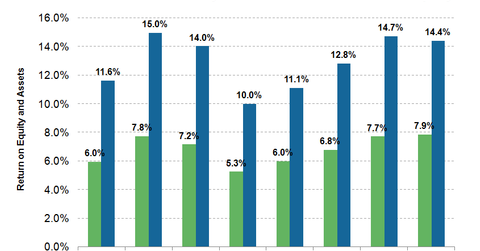

Disney’s return on equity (or ROE) increased from 2011 to 2012 but then slightly fell in 2013. However, it has managed to achieve the pre-2009 levels. Disney’s return on assets (or ROA) saw an increase from 2011 to 2012 and slightly rose in 2013 from 2012.

A six-year financial summary shows that the company has been growing its revenues, operating income, and net earnings even during the recession in 2009, when growth slowed down at its Parks and Resorts segment. Revenue from the studio entertainment segment has weakened but is expected to pick up on the back of the acquisitions of Marvel and Lucasfilm. Losses from the Interactive segment also seem to have narrowed down in fiscal 2013.