Blackstone and KKR Deployments Rise in 2016 on Valuations

Blackstone Group (BX), the world’s largest alternative manager, invested $2.9 billion during the September 2016 quarter.

Dec. 15 2016, Updated 7:37 a.m. ET

Investments rise

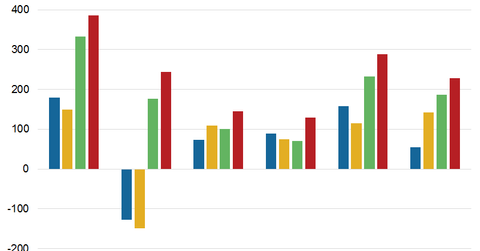

In 2016, alternative asset managers have seen a higher realization on the back of improved liquidity, valuations, and opportunities leading to churning from fund managers. The companies have also invested record amounts in the first half of 2016 as valuations have offered good long-term investment opportunities.

Blackstone Group (BX), the world’s largest alternative manager, invested $2.9 billion during the September 2016 quarter. Over the past 12 months, the company has invested a total of $6.9 billion, which reflects aggressive deployment in comparison to prior-year investments. The deployments are expected to slow down marginally, as valuations have improved across the sectors.

Investments for Carlyle and KKR

KKR (KKR) saw a strong appreciation in its public and private portfolios in 3Q16 and invested $3.7 billion mainly in private markets. The private equity component of the balance sheet makes up almost two-fifths of the company’s total balance sheet.

KKR’s total AUM (assets under management) is $131 billion. Let’s compare that to the AUM for KKR’s peers:

- Carlyle Group (CG): $169 billion

- Blackstone Group (BX): $356 billion

- Apollo Global Management (APO): $189 billion

Together, these companies form 4.3% of the PowerShares Global Listed Private Equity ETF (PSP).

Carlyle has continued to manage funds alongside strong dry powder of $54.4 billion as of September 30, 2016, down from $55.1 billion in the June quarter. Of these, $20.7 billion were left in private equity, $14.2 billion in investment solutions, $13.4 billion in real assets, and $6.1 billion in global market strategies.

Now let’s look at the real estate performances of these alternative managers.