Why Treasury Yields Fell despite Rate Hike

Higher interest rates affect bonds much more than stocks because interest rates and bond prices are inversely proportional to each other.

April 5 2017, Published 11:37 a.m. ET

Direxion

Treasurys will selloff. Or maybe not.

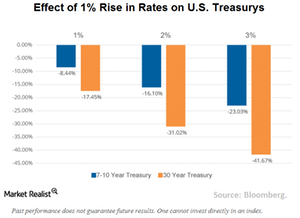

Contrary to some expectations, after the last rate hike, broader market forces drove some U.S. Treasury yields down. While the Fed can orchestrate a rise in the Fed Funds Rate, buying and selling by investors worldwide is what dictates the movement of yields in the $12.9 trillion Treasurys market. High global demand for U.S. Treasurys is lowering yields, potentially creating a conflict with conventional market expectations. Yet one thing is clear. The yield on the 30 Year US Treasury was 3.08% as of 03/03/2017. Should interest rates rise just 1%, the value of that security will drop -17.45%!

Market Realist

Interest rates and bond prices are inversely proportional

Higher interest rates affect bonds much more than stocks because interest rates and bond prices are inversely proportional to each other, meaning as interest rates go up, bond prices fall and yield moves up. As interest rates rise, the longer maturity bonds are affected more than the short maturity bonds. The rise in interest rates makes bond investment more attractive due to higher yields.

Treasury yields fell after the rate hike announcement

Following the rate hike announcement, bond yields fell as the Fed signaled a more moderate approach to future rate hikes compared to expectations of an aggressive rate hike this year. The yield on the benchmark ten-year Treasury notes (TMF) (TMV) fell to around 2.5%, while the yield on the two-year note fell to 1.3%. The yield on the 30-year Treasury bond was also lower at 3.1%.

Higher demand

In recent years, US Treasuries (TYD) (TYO) witnessed higher demand spurred by investors seeking better returns amid negative yields and the record low rates prevalent in most of the developed world. Between 2008 and 2013, the Federal Reserve’s custody holdings of U.S. Treasuries for foreign central banks and other international institutions more than doubled to reach $3 trillion, while in September 2015, it peaked to $4.2 trillion. Though the demand for US Treasuries (TYNS) has softened since then, it still remains healthy. The higher demand for US Treasuries puts pressure on yields.