Alternatives’ Deployments May Remain Stable on Fundamentals

In 2016, alternatives saw higher investments as well as exits on the back of improved liquidity, rising markets, higher valuations, and distressed pricing in corporate credit.

March 16 2017, Updated 7:37 a.m. ET

Deployments in 2017

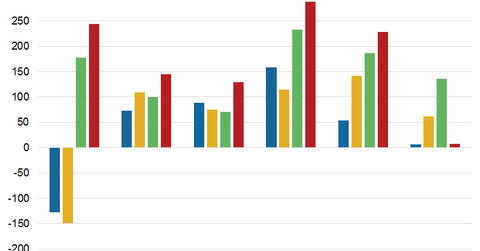

In 2016, alternatives saw higher investments as well as exits on the back of improved liquidity, rising markets, higher valuations, and distressed pricing in corporate credit. Investment growth could be lower in 2017, as valuations are high and any steep rise in interest rates could lead to a pullback in equities.

Alternatives have deployed investments at low valuations, targeting select sectors and companies. These investments, along with higher distributions, could attract more capital toward investment offerings.

In 4Q16, Blackstone Group (BX), the world’s largest alternative asset manager, managed strong realizations with its highest exits at $3.5 billion in its real estate division and $3.8 billion in private equity. The company has maintained a high rate of realizations over the past few years.

KKR (KKR) saw investments of $3 billion in 1Q17. The company deployed a total of $11 billion across the Americas, Asia, and Europe in 2016. The private equity investments make up almost 50% of the company’s total balance sheet.

Carlyle’s energy investments

The Carlyle Group (CG) has seen some rebound in its energy investments with its legacy energy portfolio rising 9% in 4Q16 due in part to a rebound in oil prices (USO). Overall, the long-term outlook for oil remains subdued.

On the demand front, manufacturing activity is slowing down across the major hubs including China and other export-driven countries. However, there’s strong demand from India for commercial as well as industrial usage.

Apollo Global Management (APO) has seen improved churning of capital in 2H16 as valuations of holdings have improved, giving rise to performance fees. Together, these companies form 4.2% of the PowerShares Global Listed Private Equity ETF (PSP).

Now let’s study the real estate performances of alternative asset managers.