What does KKR’s revenue model look like?

KKR has a diverse revenue model, making fees for providing investment management to its funds, investment vehicles, managed accounts, and finance companies.

March 7 2015, Updated 10:05 a.m. ET

KKR’s revenue model

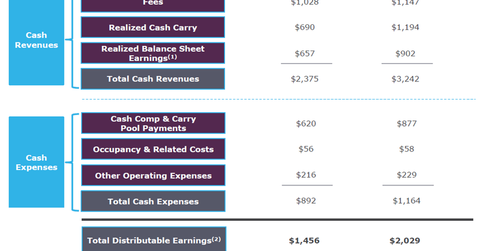

KKR & Co. L.P. (KKR) has a diverse revenue model. KKR makes management, monitoring, transaction, and incentive fees for providing investment management services to its funds, investment vehicles, separately managed accounts, and specialty finance companies. It also generates transaction-specific income from its capital market transactions.

KKR also makes additional investment income from the capital invested by its general partners. It receives carried interest from its investment funds and other investment vehicles. Carried interest income is generated as the specified percentage of the investment gains generated on third-party capital investments.

Performance-linked revenues

KKR charges gross management fees for its private equity funds between 1% and 2% of the committed capital during the investment period. It also charges 0.75% of the invested capital after the expiration of the investment period. This reduces subsequently until the time the portfolio is liquidated.

KKR also charges some monitoring fees from its portfolio companies for providing them with management, consulting, and other services. It also receives transaction fees for providing financial advice to its portfolio companies.

The company charges performance fees in certain funds. The fee is usually between 10% and 25% of the net profits earned by investors in excess of the performance hurdles. The performance hurdles are usually tied to the index performance over the period of the fund.

Iin order to attract the majority of new funds, KKR has to perform in line with or better than its competitors. KKR’s competitors include The Blackstone Group (BX), The Carlyle Group (CG), Apollo Global Management (APO), and asset managers that form part of the Financial Select Sector SPDR Fund (XLF).