Higher oil prices are a potential double whammy for propane sales

Propane distributors such as Amerigas Partners (APU), Ferrellgas (FGP), and Suburban Propane (SPH) sell propane and related equipment to a variety of end markets. Find out what trends could hurt propane names this winter.

Nov. 20 2020, Updated 11:10 a.m. ET

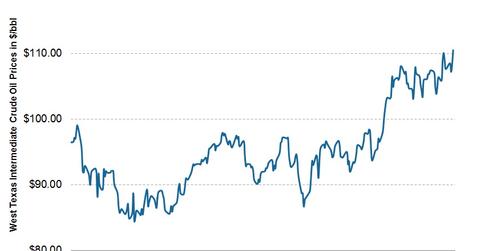

Oil prices increased significantly over the past few months

WTI crude oil prices rose from ~$95 per barrel in mid-June to levels of $110 per barrel now. Geopolitical tensions in the Middle East as well as supply disruptions in Libya were the major factors contributing to this (for more on those developments, please see Why Middle East and North Africa turmoil could cause an oil price spike and Why crude oil traded higher on fears of further unrest in Syria). High crude prices are generally negative indicators for propane distributors for two major reasons: the possibility of higher gasoline prices and propane’s price correlation to crude oil.

More expensive gasoline could sap consumer purchasing power

As gasoline is a product of refined crude oil, higher crude prices generally result in higher gasoline prices (though note that the relationship doesn’t perfectly correlate).

According to the U.S. Energy Information Administration, U.S. household spending on gasoline used nearly 4% of pretax income in 2011 and 2012. More expensive gasoline could significantly decrease U.S. consumer purchasing power, which could cause increased conservation by customers of propane distributors. All else equal, this would result in fewer volumes sold, and therefore reduced earnings.

Propane prices also somewhat correlate with crude oil

Plus, higher oil prices can represent a double whammy, as propane prices have also historically correlated with crude oil prices. Higher propane prices also reduce customer demand for the heating fuel, as we discussed earlier in this series. Though the relationship between propane and crude has weakened somewhat over the past year, crude prices can still significantly affect propane prices.