Orbitz Worldwide Inc

Latest Orbitz Worldwide Inc News and Updates

Consumer Why Priceline and Expedia clash over “opaque” hotel offerings

Priceline earns the majority of its revenues from the agency model, under which third parties such as hotel suppliers set the rates while Priceline earns a commission on the transaction.

A key overview of global online travel company Orbitz Worldwide

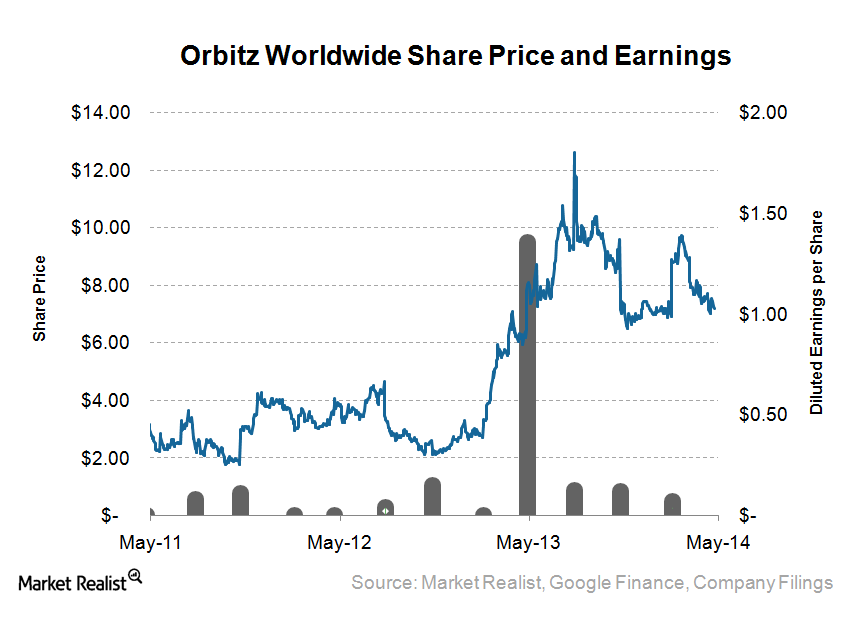

The Chicago-based Orbitz Worldwide Inc. (OWW) is a global online travel company (or OTC). It recently posted a net loss for the first quarter of 2014 although its revenue grew, driven by hotel bookings.